Workers’ Comp Data: Restaurant and Hospitality, Educational Services Industries Still Experiencing Low Volume of Workers’ Comp Claims

Data analysis by Aarthi Thiruvengadam. As the COVID-19 pandemic goes on, the workers’ compensation industry is still continuing to manage changing claim patterns and trends. As regulations and case rates continue to shift, Mitchell has analyzed its workers’ compensation claims data to identify how claim trends have changed over the past year and a half. Below, we’ve shared our top takeaways based on our analysis. This report includes claim data through June 30, 2021.

Key Findings from Mitchell Data

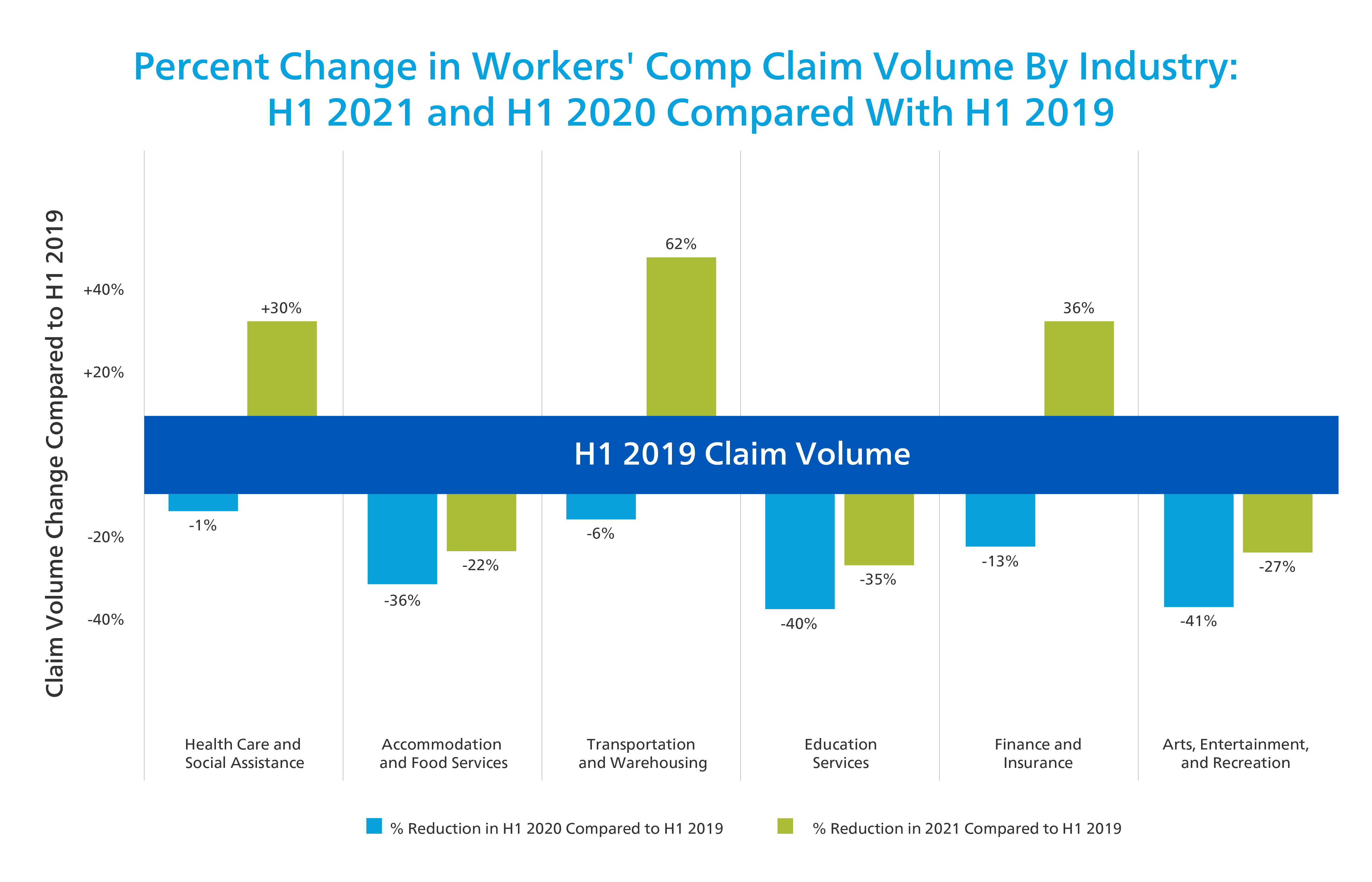

- While some industry sectors, like healthcare and retail trade, are showing signs of returning to—and in some cases exceeding—normal levels of workers’ compensation claim volume, the accommodation and food services industry is still reporting significantly fewer claims when compared to 2019, which could be a result of the well-documented labor shortage. Other industry sectors that have been subject to heavy COVID-19 regulations, like the arts and entertainment industry and the educational services industry, have also not seen a return to pre-pandemic claim volumes.

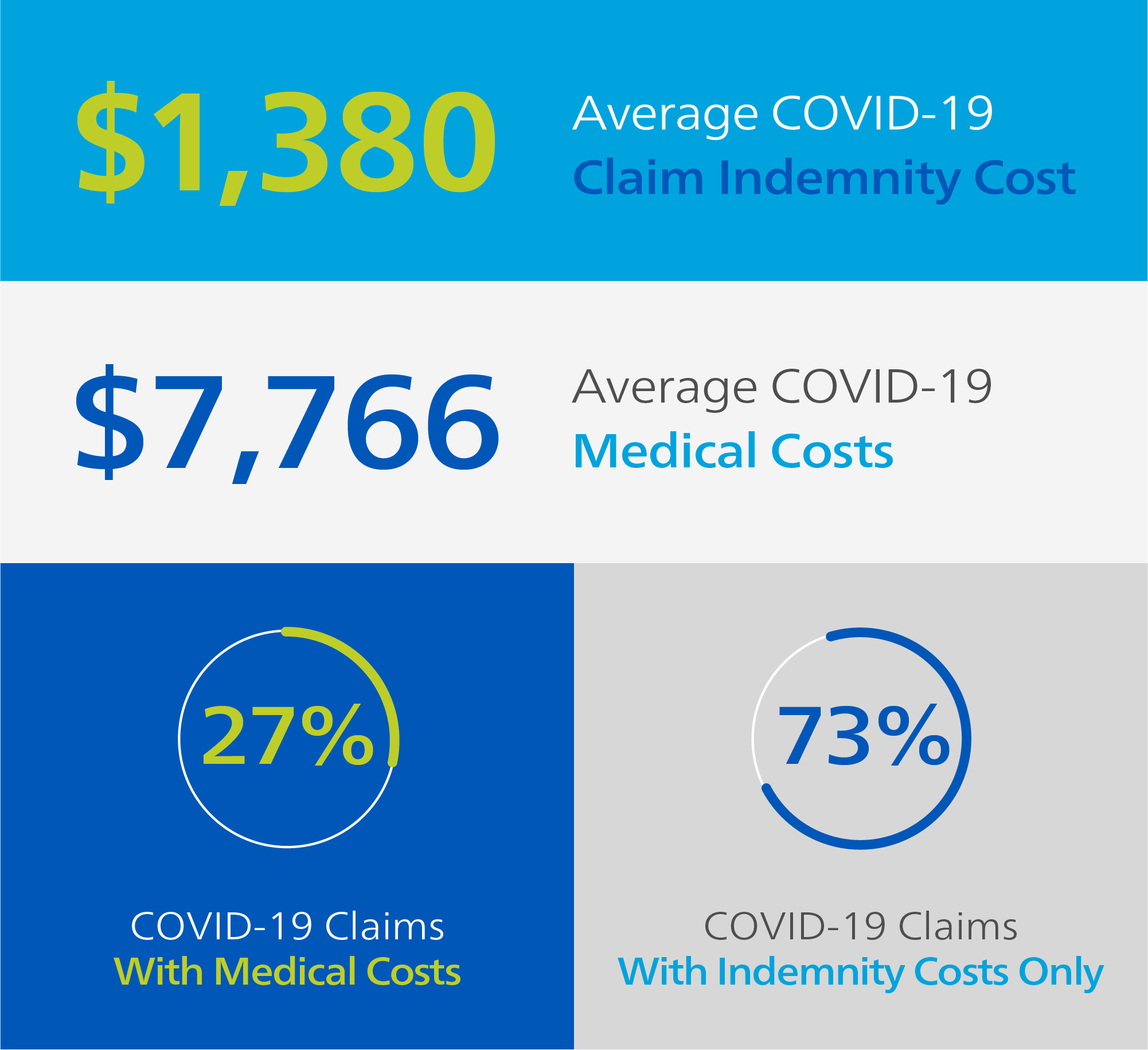

- The majority of COVID-19 claims continue to include only indemnity costs (73%) and don’t have associated medical costs, though the average indemnity cost (lost wages) of COVID-19 claims decreased by 43% compared to Mitchell’s last report.

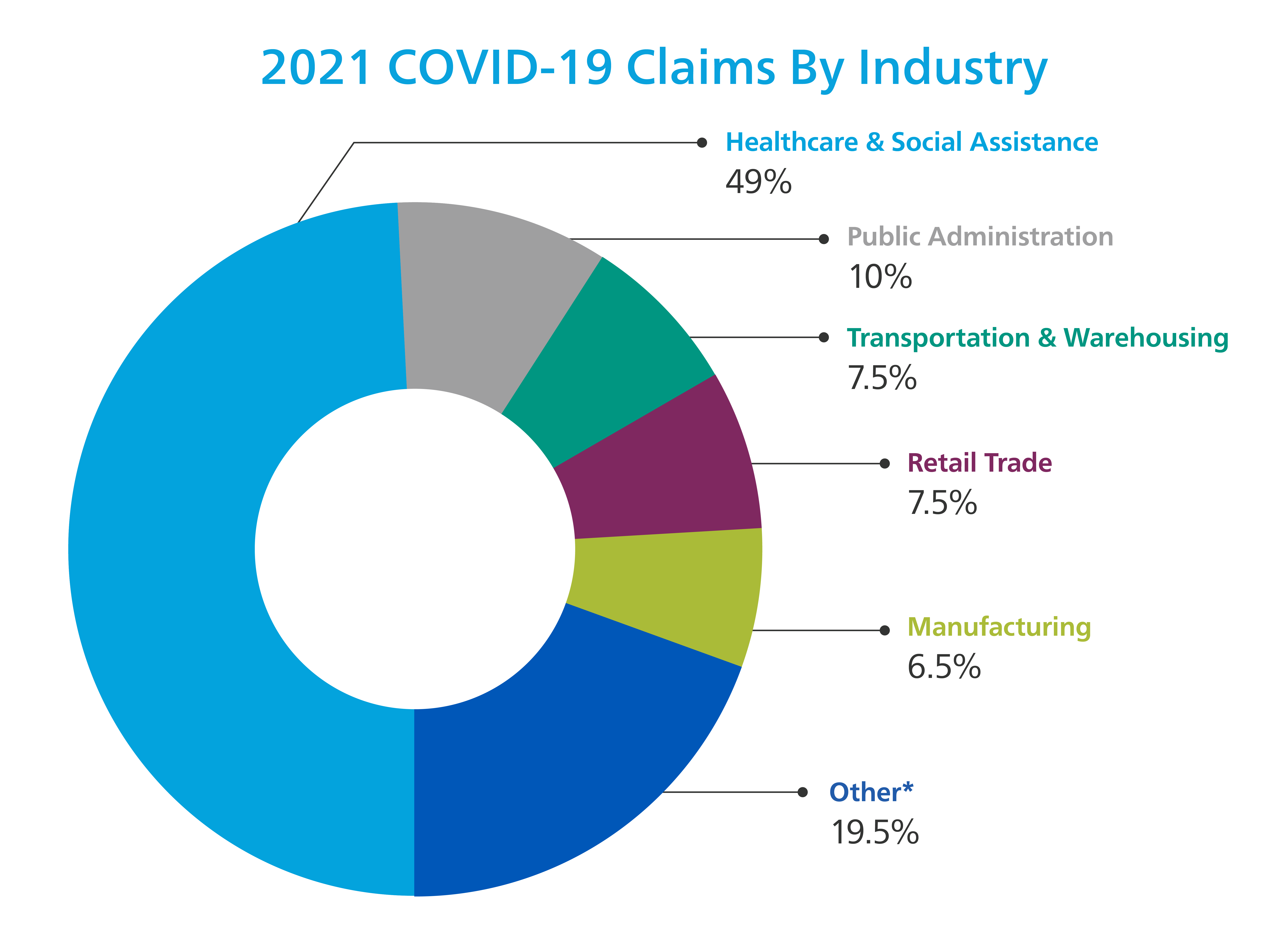

- Employees representing the healthcare industry sector are still the largest source of COVID-19-related workers’ compensation claims— from the start of the pandemic through June 2021, about half of all COVID-19 claims and about five times greater than any other single sector.

Accommodation and Food Services, Arts, Entertainment, and Recreation, and Educational Services Industries Have Not Yet Reported Pre-Pandemic Claim Volumes

Since COVID-19 vaccines rolled out across the country during the first half of 2021 and many restrictions were lifted in the past few months, many industries across the country began recovering from the effects of the pandemic. Through an analysis of Mitchell’s workers’ compensation claims data, we’ve been able to identify how the period of recovery many industries underwent throughout the first half of this year has influenced workers’ compensation claim trends. From January through June 2021, the finance and insurance, transportation and warehousing and healthcare and social assistance industries reported significantly more workers’ compensation claims than in the first half of 2019. On the other hand, Mitchell’s data reveals that some industries have not seen pre-pandemic claim volumes return. The arts, entertainment, and recreation, educational services, and accommodation and food services industries are all still reporting significantly fewer workers’ compensation COVID-19 claims. Though claim volumes are still down, all three of these industries are experiencing an increase in claims compared to 2020 volumes, but are subject to pandemic-related regulations and trends that may explain the lower volume of claims.

Accommodation and Food Services

While most of the COVID-19 restrictions that affected the accommodation and food services industries have been lifted, they are currently experiencing a major labor shortage, which may explain the decrease in workers’ compensation claim volume. Though the number of seated diners in the United States has mostly returned to 2019 levels according to OpenTable, the industry’s unemployment levels in June 2021 were down 5 percentage points compared to June 2019, according to the Bureau of Labor Statistics. The industry experienced similar levels of unemployment in the other months of 2021. It makes sense that with significantly fewer employees working in the industry, there would be fewer workers’ compensation claims. We expect that claim volume won’t entirely return to pre-pandemic levels in the industry until the labor shortage has been resolved. Mitchell will continue to evaluate this trend and through the end of the year.

Arts, Entertainment, and Recreation

This industry sector includes performing arts, spectator sports, museums, gambling and more. COVID-19 regulations prohibiting large events were some of the last to be lifted when states began softening regulations, which most likely explains this industry’s slow return to pre-pandemic claim volumes.

Educational Services

This industry’s slow return to pre-pandemic claim volumes can be attributed to virtual learning. In the first half of 2021, educational-related COVID-19 regulations varied widely across the country, and many students continued virtual learning throughout the school year. For example, in California, less than half of public school students returned to in-person learning as of April 30 last year, even though almost 90% of all schools had opened for at least hybrid learning, according to edsource.org. With fewer in-person school educators across the country, it makes sense there would be fewer workers’ compensation claims. The Centers for Disease Control and Prevention (CDC) recently released new guidance for the 2021-22 school year, placing a strong emphasis on returning to in-person learning. As schools re-open for classroom-based instruction, we expect to see workers’ compensation claim volumes increase to pre-pandemic levels.

COVID-19 Indemnity Claim Costs are Decreasing

This chart shows costs related to COVID-19 claims. COVID-19-related claims are defined as any claim with a Nature of Injury Code related to the virus (testing, treatment, etc.). The % change number compares the changes between Mitchell’s previous data report, January-December 2020 and our current report, January 2020-June 2021.

About a quarter of workers’ compensation COVID-19 claims include only indemnity costs (no medical costs)—and those costs have declined over time. In January 2021, Mitchell reported that the average indemnity cost (lost wages etc.), for a COVID-19 claim was $2,400 in 2020; now, that number has decreased by almost half to $1380. On the other hand, average medical costs associated with COVID-19 claims have remained somewhat steady, with just a slight 5% increase since Mitchell’s last report. According to NCCI, the makeup of claim types is a clear reversal when compared to historical workers’ compensation claim data—prior to the pandemic, about 75% of all workers’ compensation claims were medical-only. NCCI published similar findings to Mitchell’s data, reporting that 75% of COVID-19 claims were lost-time claims.

The Healthcare Industry is Still the Top Source of Workers’ Compensation COVID-19 Claims

- January-June 2020: Healthcare was the source of 66% of COVID-19 claims

- January-December 2020: Healthcare was the source of 52% of COVID-19 claims

- January 2020-June 2021: Healthcare was the source of 49% of COVID-19 claims

Of note, we haven’t seen any particular industry that has experienced a spike in COVID-19 claims—most of the changes have been subtle. As time goes on, we anticipate that while the healthcare industry will continue to be the largest source of COVID-19 claims, but it is possible that we will continue to see slight changes in the makeup of industries that are reporting COVID-19 claims, depending on vaccination rates and jurisdictional regulations.

Our Data

The data in this article is an aggregate of Mitchell statistics from workers’ compensation claims from January 1, 2020 through June 30, 2021. Industries were identified as per the two-digit North American Industry Classification System (NAICS) code classifications. Mitchell plans to publish another report in early 2022 to show how trends shift through the second half of 2021. You can read our previous reports here: January-June 2020, January-December 2020. *Other category contains: Agriculture, Forestry, Fishing and Hunting, Mining, Quarrying, and Oil and Gas Extraction, Utilities, Construction, Wholesale Trade, Information, Finance and Insurance, Real Estate and Rental and Leasing, Professional, Scientific, and Technical Services, Management of Companies and Enterprises, Administrative and Support and Waste Management and Remediation Services, Arts, Entertainment, and Recreation, Accommodation and Food Services, Educational Services, Information, and Other Services (except Public Administration).