Photo-Based Estimating (PBE) Seeing Exponential Growth

Insurance companies continue to seek ways to improve customer satisfaction while driving production efficiencies. Historically, most insurance companies offered three, maybe four standard methods of inspection (MOI’s) to assess damages to a vehicle in the claims process. These standard methods often include: a direct repair program (DRP), staff inspection at the vehicle’s location if within a staff member’s territory; or inspection by an independent appraiser. Less commonly employed options include, service centers operated by the insurer, and various forms of electronic communication between the insurer and repair facility. In the last decade, smartphones have changed consumer preferences for convenience, self-service applications have emerged, and marketing campaigns by insurance companies have raised customer expectations. With these trends in mind, we undertook a review of Mitchell’s vast assignment data to determine if carriers are migrating to more efficient virtual estimating versus the more traditional field inspection MOI.

Analysis Approach:

Objective: Assess any changes occurring in insurer/claimants’ preferred method of inspection, and impacts of these changes.

- Time period of the data review: 2013 to 2017 (Full year, mature data)

- Assess trends in damage severity and repair supplement rates by MOI

- Determine percentage of MOI assignments going to:

- Staff field inspection

- Independent appraiser

- Carrier administered PBE (administered and written by the insurer)

- Third-party PBE (third party administers the image collection and estimating)

Image 1: Example of a Consumer-Facing Claims Photo Capture Non-Native Application

Assignment Data Analysis Results:

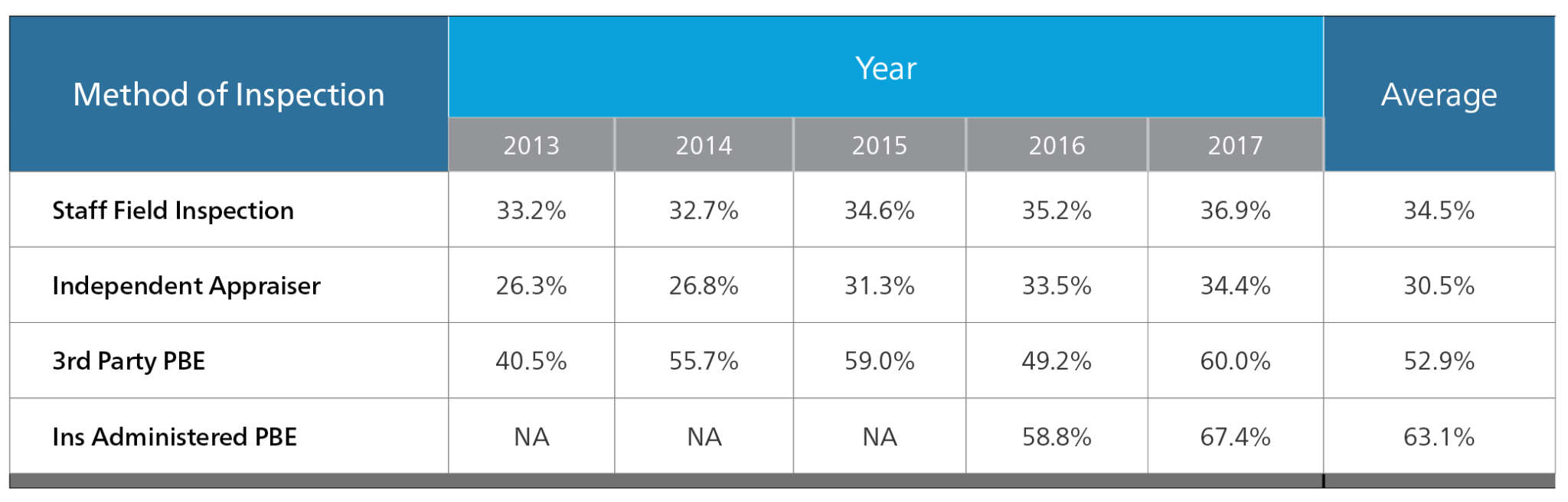

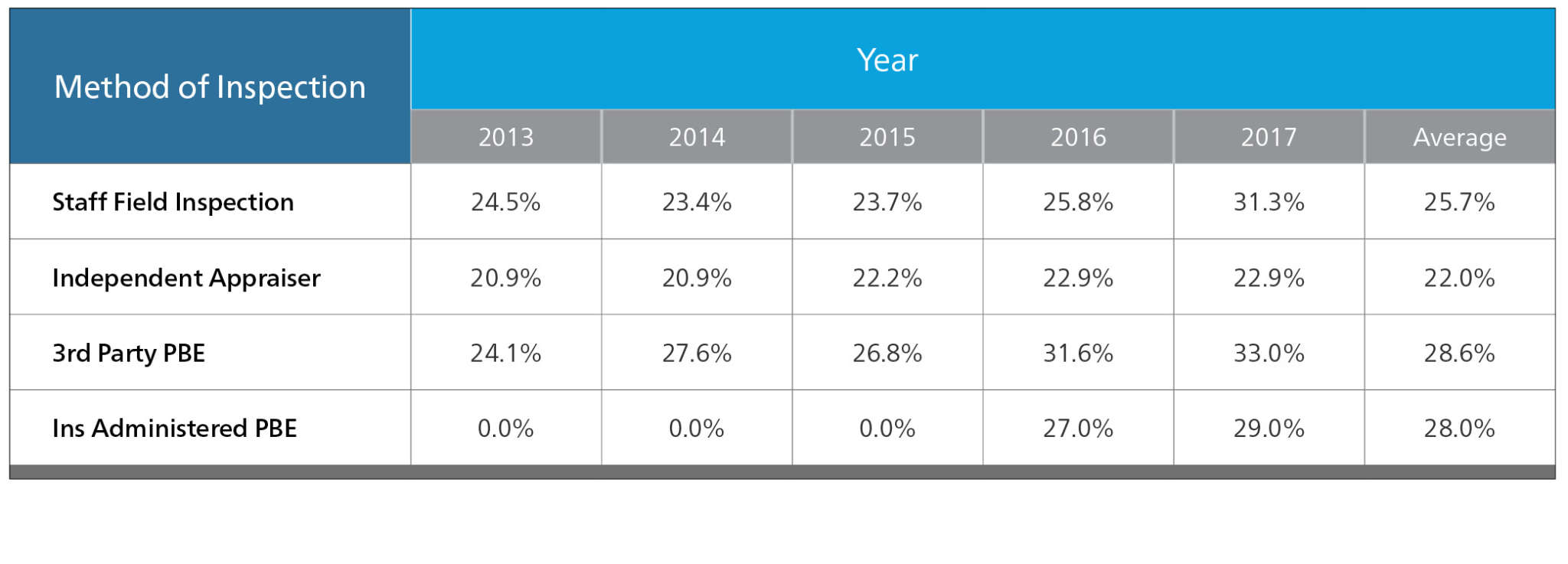

Table 1: Field Inspection vs Virtual Estimating Changes—2013 to 2017

Mitchell data shows a ten-fold increase in insurer administrated PBE from 2016 to 2017, with a corresponding drop in staff field inspections. Additionally, use of IA’s more than doubled. The general trend appears to be a reduction in staff field inspections and an increase in insurance-administered PBE, with staff reductions resulting in additional IA utilization. A concerning element in the shift towards photo-based estimating is found in supplement data. The following two tables highlight the net supplement amount and rate by MOI.

Table 2: Supplement Amount (as % of original estimate), 2013 through 2017

Supplement amounts for PBE are higher than other channels with the average amount exceeding 50% of the original estimate. While the supplement amount tends to be higher as a % or the original PBE, it is worth noting that the dollar increase compares relatively more favorably to other channels. This is a result of channels other than PBE typically deployed on higher-valued repairs, and PBE most typically employed on lower value repairs.

Table 3: Supplement Rate Comparison, Percent Comparison, 2013-2017

Supplement rates on PBE are consistent with other channels.

Implications for Continued Growth with PBE Usage

As the data reveals, PBE is becoming a popular, cost-effective method of inspection option. In 2017, nearly 15% of all insurance written estimates were completed using PBE. While the supplement rate is higher than other channels, PBE does provide for a productive means of determining damages. Estimator productivity is typically increased substantially, from three to four field appraisals per day to more than 15 to 20, as well as reducing expenses associated with staff appraisers’ travel. Additionally, claims can be adjudicated in a customer friendly manner, offering vehicle owners the convenience of submitting photos over the phone.

As the data reveals, photo-based estimating is becoming a popular, cost-effective method of inspection option for claimants and insurance companies.

Future Trends with PBE to Improve Accuracy

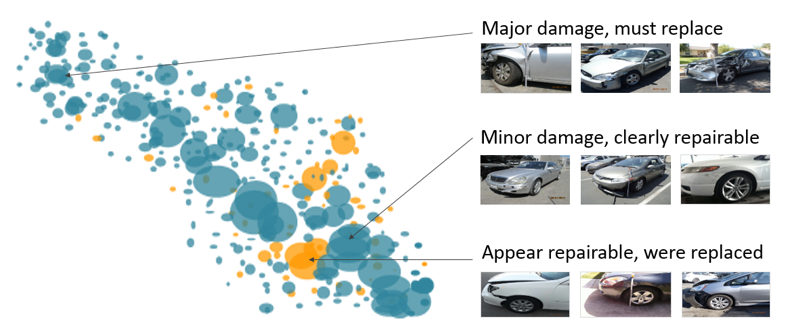

While original PBE estimates generate more supplements than DRP-written estimates, technology advances are coming that may significantly improve the PBE quality. Visual recognition technologies are progressing rapidly. When combined with machine learning and the use of historical estimate data, software will soon be able to reliably create an estimate that can be quickly affirmed or edited by an appraiser.

Image 2: Computer Photo Vision to Better Identify Repair/Replace Decisions

Mitchell has developed technologies using computer photo vision to identify body panels and determine which panels may be repaired, and which require replacement. As Mitchell refines this technology, it will work its way upstream in the claims process, assisting photo-based appraisers by ensuring, consistent, accurate decisions.

Conclusion: Photo-Based Estimating is Rapidly Becoming A Preferred MOI

Photo-based estimating was introduced as a viable method of inspection six years ago. All indications suggest this inspection channel will continue to grow in popularity with consumers, and continue to deliver increased benefit for carriers and repair facilities. While supplement rates are high, advances in technology will continue to improve PBE accuracy. If you have not considered PBE as a method of inspection option, now may be the time. Hans Littooy is Vice President, Professional Services in Mitchell International’s Auto Physical Damage business unit.