How to Better Review Costly Hospital, Emergency Room and Other Medical Bills for Third Party Claims

Motor vehicle accidents led to more than 2.5 million emergency department visits in 2017, according to the CDC’s most recent estimates. Emergency room and other hospital visits can be costly for insurance carriers, as facility charges are some of the highest fees that carriers face when paying for medical treatments related to auto accidents. In fact, a recent Mitchell analysis of third party bills revealed that while inpatient facility bills represented only 1% of all of the bills a carrier evaluated, they made up almost 11% of total charges evaluated. Meanwhile, outpatient facility bills represented 22 percent of all bills evaluated, but 33 percent of total charges. While facility and other medical bills within third party demand packages can be particularly pricey, many claims organizations do not have a consistent method or benchmark available for referencing costs. In addition, there may be issues with non-standard facility itemizations being provided instead of the UB-04 bill-level details that are necessary for processing appropriately with Medicare. This often causes adjusters to spend extra time looking for potential adjustments and sometimes results in insurance carriers paying more than the fair price for third party claims.

Using Medicare to Manage Third Party Bill Costs

One way that carriers can address this problem is to use the medicare fee schedule as a pricing benchmark for evaluating third party medical bills within a demand package. Medicare is a nationally recognized and transparent fee schedule, which can help guide adjusters in consistently and accurately negotiating bills and explaining those adjustments. For easy and consistent application, carriers can set up the Medicare fee schedule as the pricing benchmark in their bill review system and customize an optional percentage multiplier of Medicare that they would like adjusters to use across the organization.

Three Benefits of Using Medicare Fee Schedule Pricing

1. Provide Comprehensive Fee Coverage for Third Party Medical Bills

Adjusters are sometimes on their own to determine the most accurate price for services rendered when evaluating medical bills in a third party demand package. Implementing Medicare or a certain percentage multiplier of the Medicare fee schedule as the pricing benchmark for third party bills helps to provide adjusters with an easy, consistent and understandable way to apply pricing.

2. Improve Adjuster Negotiation

In order to settle a third party claim, carriers typically have to negotiate with an attorney or claimant. In the negotiation process, it can be challenging for adjusters to explain bill adjustments if they were not all derived using a widely-accepted or consistent methodology. Medicare provides a standard, well-published and transparent rate that adjusters are typically comfortable explaining and attorneys can easily understand, which can lead to more successful negotiations.

3. Boost Adjuster Efficiency

Integrating Medicare fee schedule pricing directly into a carrier’s bill review platform can help improve adjuster workflow efficiency by streamlining the bill review process. Providing this information directly in the system can help speed up an adjuster’s ability to complete their tasks as adjusters no longer need to spend time manually looking up fee schedules in an external application when existing benchmark rates are not available.

Case Study: Using Medicare to Evaluate Third Party Medical Bills in a Demand Package

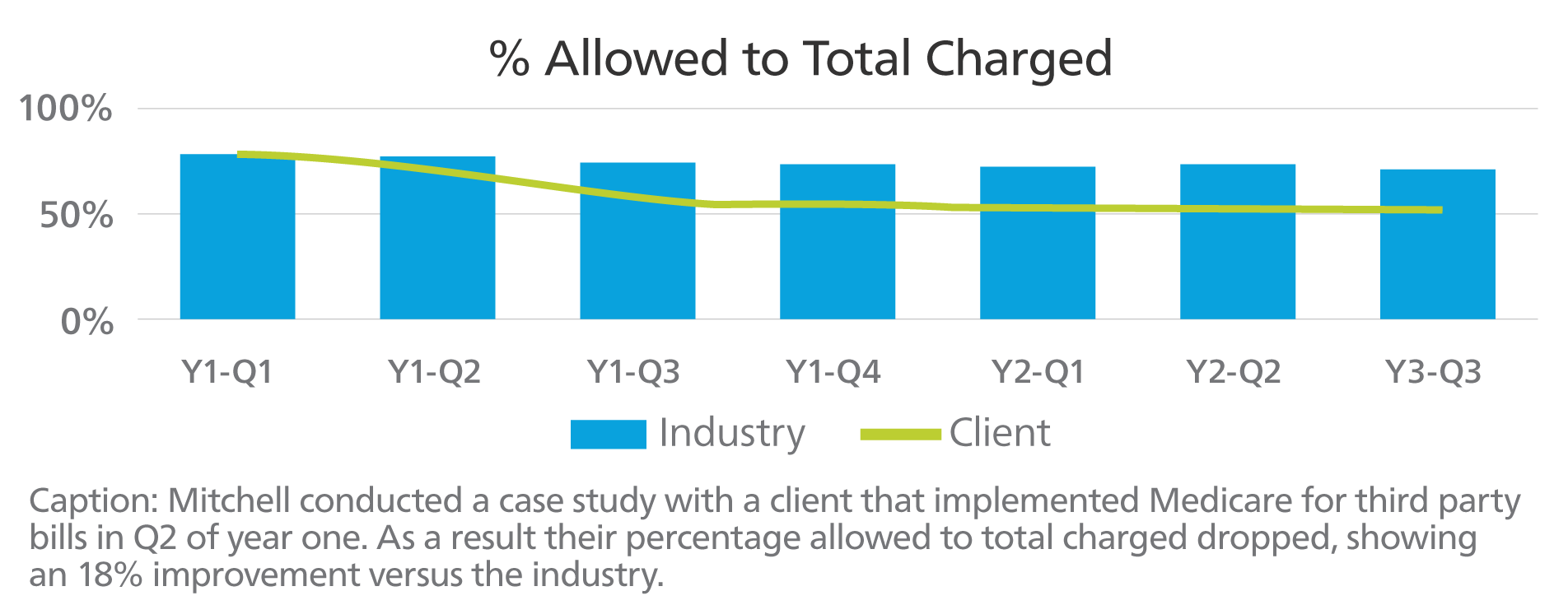

Mitchell conducted a case study that demonstrated some of the benefits of implementing Medicare within a carrier’s bill review platform. Prior to using the Medicare fee schedule, the client in the case study on average had a recommended amount which was approximately the same percentage charged as the industry for third party bills. After the client implemented the Medicare fee schedule as a benchmark for third party claims, their percentage allowed to total charged dropped, showing an 18 percent improvement versus the industry.

Mitchell conducted a case study that demonstrated some of the benefits of implementing Medicare within a carrier’s bill review platform. Prior to using the Medicare fee schedule, the client in the case study on average had a recommended amount which was approximately the same percentage charged as the industry for third party bills. After the client implemented the Medicare fee schedule as a benchmark for third party claims, their percentage allowed to total charged dropped, showing an 18 percent improvement versus the industry.

Better Manage Third Party Medical Bill Costs

By implementing the Medicare fee schedule rates as a reference, carriers can begin to better manage their cost to settle bodily injury claims. Medicare is a well-known industry standard that adjusters can use to understand medical bills, carriers can improve adjuster efficiency and provide adjusters with a better chance for successful negotiations with attorneys and claimants.