Forecast the Future

Keeping up with endless industry changes is no easy task. Enlyte’s leaders are constantly interacting with clients, like you, to ensure we know exactly what’s keeping you up at night and working to create solutions that impact your bottom line. Listen as our experts discuss their predictions for 2024 and beyond. Then let us help you align a strategy to tackle them head on.

Simplify With Enlyte

Technology

As a market leader with more than 75 years of experience, we simplify and accelerate claims management through the broadest range of technology solutions and partners in the industry.

Clinical

Our care management solutions help injured employees return to their jobs in a safe and efficient manner through compassionate medical management while reducing total claim cost.

Networks

Coventry network solutions include a full spectrum of network offerings, including auto and workers' compensation, broad-based, state-certified, outcomes-based and customized, and specialty available to serve you for a single market or with nationwide coverage.

One Size Does Not Fit All

At Enlyte we strive to maximize value through product integration, provide holistic solutions to client challenges, and view stewardship as a 24/7/365 initiative. This unique approach allows us to anticipate client needs throughout the life of a claim.

"Enlyte is very accommodating of our needs. Rather than push their own objectives, Enlyte understood our goals and worked diligently to ensure that each timeline was met and each goal exceeded expectations."

—Vice President Medical Management, Regional Carrier

Smarter Solutions

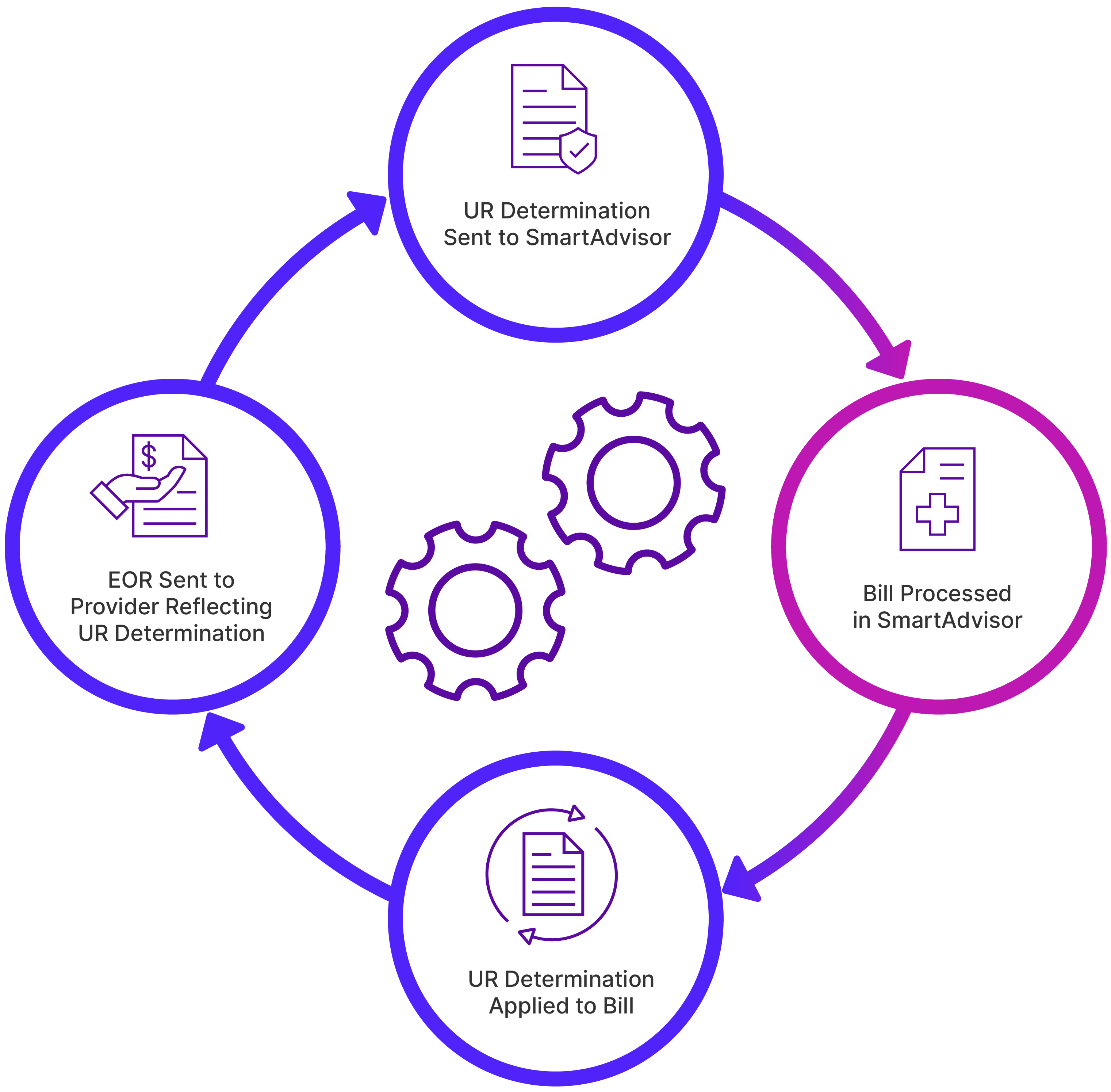

Utilization Review + Bill Review

By integrating our utilization review and SmartAdvisor bill review solutions you can capture 2% of unrelated charges and 17% of previously denied services.

Efficiencies

- Saves time for adjusters and case managers

- Eliminates risk of error or applying UR decision manually

Savings

- Improves UR savings by consistently and automatically applying UR decisions

Outcomes

- Expedites care coordination for the injured employee

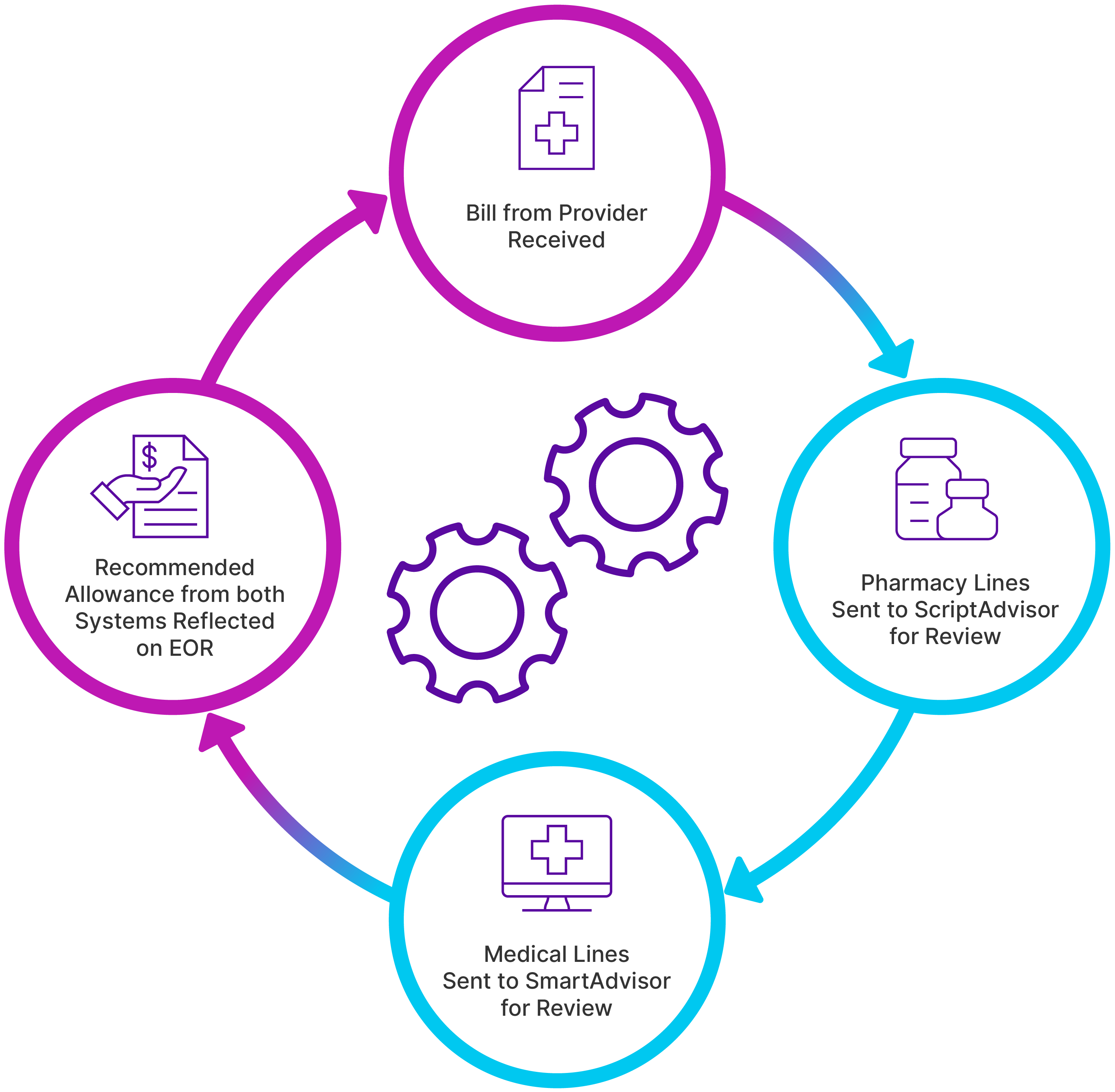

Bill Review + Pharmacy Benefit Management

By integrating our bill review and ScriptAdvisor pharmacy solutions you can achieve 100% visibility into your pharmacy spend.

Efficiencies

- Provides better visibility into the full treatment patterns and pharmacy spend, leading to more accurate decisions for adjusters

- Simplified workflow for Claims Examiner Portal users

- Integrated reporting and analytics

Savings

- Lower total cost of ownership with accelerated implementations

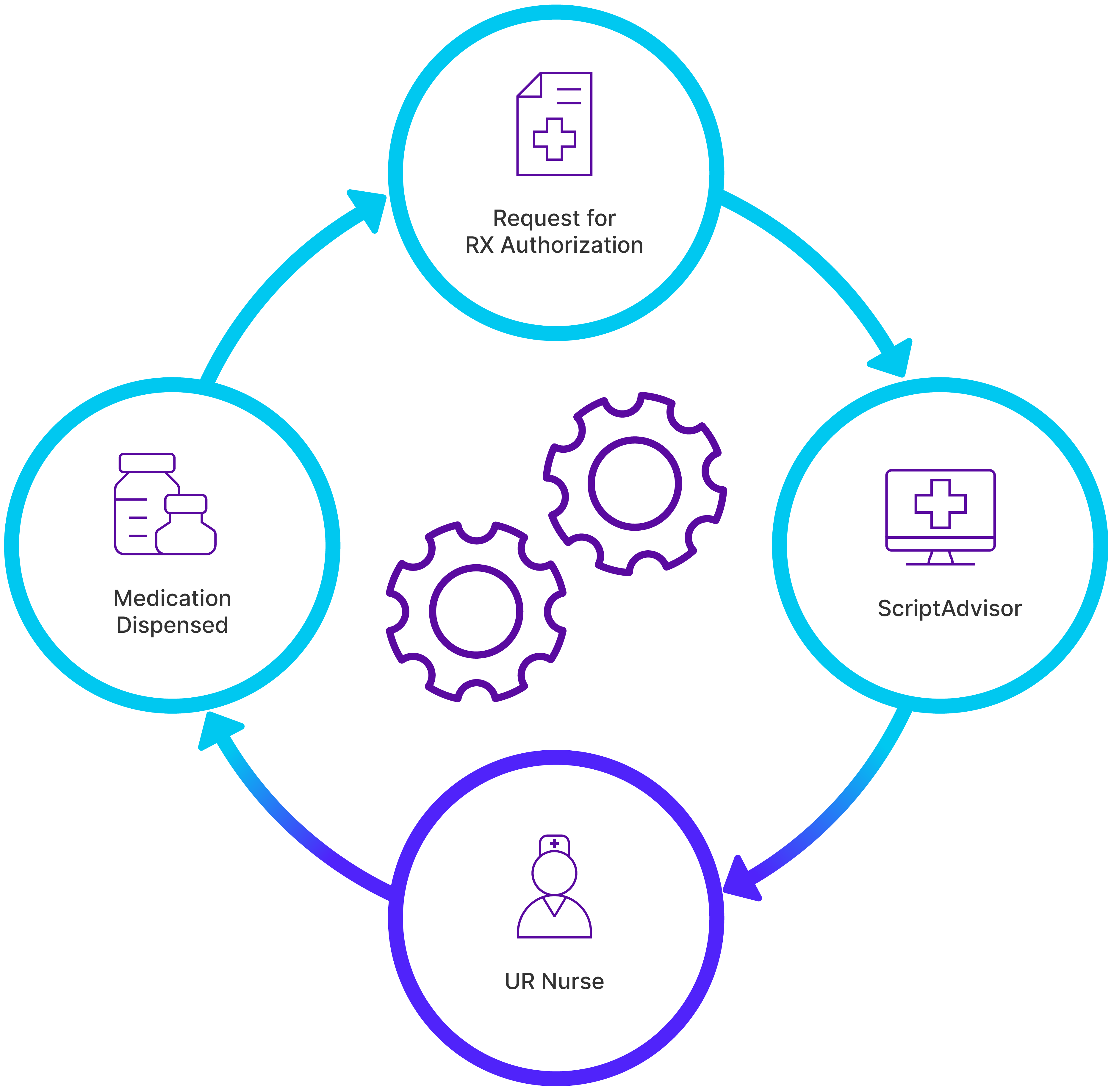

Utilization Review + Pharmacy Benefit Management

By integrating our utilization review and pharmacy solutions you will increase adjuster efficiency and remove administrative burden.

Efficiencies

- Automated communication to adjuster or case manager of UR outcome

- Simplifies the medical decision-making process

Savings

- Reduces UR costs via smart-routing parameters

Outcomes

- Consistent application of treatment on every claim

Better Together

We are committed to protecting dreams and restoring lives by delivering a collection of capabilities across technology, clinical services and networks. Through integrations and intersections, be it technical, workflow or data, we can deliver optimal claim outcomes. Our flexible, customizable solutions and technologies help you achieve greater savings, outcomes, and efficiencies.

Brighter Integration Case Studies

Read real-life stories on how integrating solutions delivers savings, efficiency and outcomes.

Savings

Integrated Bill Review and PBM program results in double digit savings

Efficiency

Carrier client saves on both loss and expense on integrated program

Outcomes

Employer client partners with a TPA and Enlyte to deliver optimal outcomes

“All the people we work with directly are incredibly responsive and transparent. They are there for us when we need them. It's less about the product itself and more about the interaction.”

—VP of Claims Operations, Regional Carrier

Using Data to Influence Claim Decisions

Industry experts from Sentry Insurance and Enlyte discuss how they're using data to influence claim decision making through descriptive, diagnostic, predictive and prescriptive analytics.