The State of Third Party Auto: Claim Costs, Consistency and a New Generation of Adjusters

The cost of third party auto claims is rising quickly, and many insurance carriers are struggling to keep up. As the number of attorney-represented claims grows, adjusters are getting more and more demand packages, which are often disorganized or incomplete, though they require a timely response. Without the correct tools, these complex demand packages often result in lost opportunities or inconsistencies, which can expose insurers to lawsuits. Because there are so many different variables when handling represented third party claims, things can quickly get complicated for adjusters. Often, those complications and problems lead to unnecessary spending. In a competitive auto casualty market, an insurance company can’t afford to leave these costly problems unaddressed.

A partner that offers an integrated solution set is a great choice, since the integration ensures that no parts of the process get lost.

Though there are many issues that arise while adjudicating third party claims and demands, three major problems stand out across the industry—the rising cost of third party claims, inconsistent evaluation and claim settlements, and a new generation of adjusters.

Breaking Down the Three Biggest Industry Challenges

Challenge 1: Rising Cost of Third Party Claims

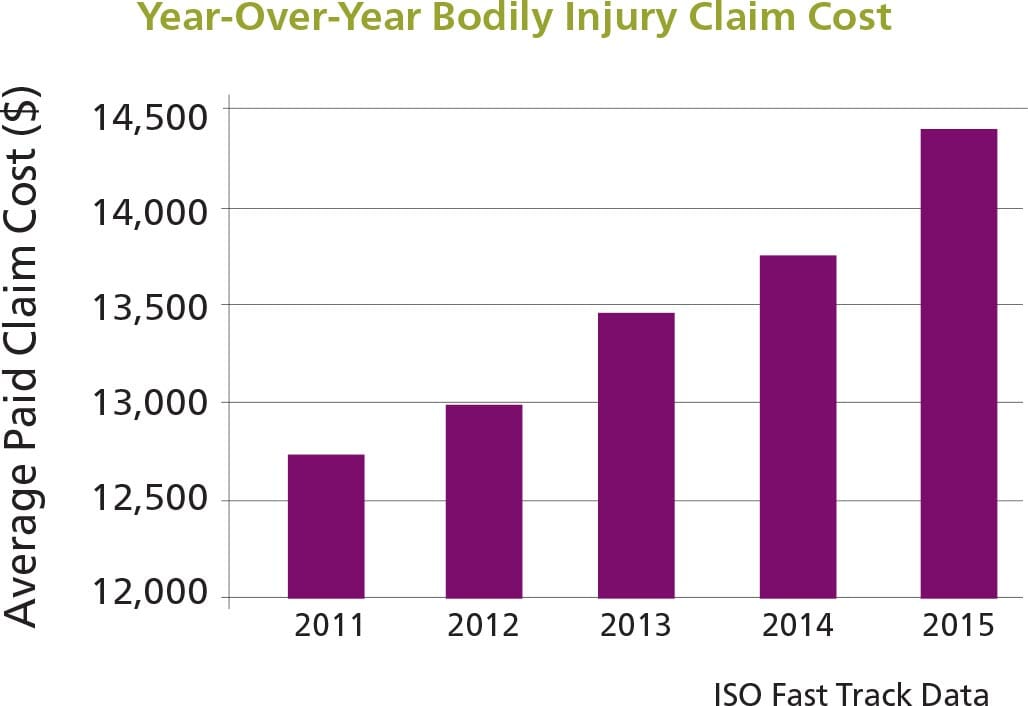

One of the biggest obstacles the industry is facing is rising claim costs which are directly related to increased medical specials. Since 2011, the average bodily injury claim cost for third party medical specials has increased about 12 percent.  In fact, when we look more closely at the numbers behind these increases, we see that average utilization, or the frequency of using medical services, has also increased by 18 percent during the same period according to Mitchell data.

In fact, when we look more closely at the numbers behind these increases, we see that average utilization, or the frequency of using medical services, has also increased by 18 percent during the same period according to Mitchell data.

Causes and Effects

The cause of the rising costs can’t be attributed to just one single factor, such as inflation. Medical specials on third party auto claims are rising due to a few complex reasons that fall into three categories: provider-related trends, fraud and adjuster struggles.

Provider-Related Trends

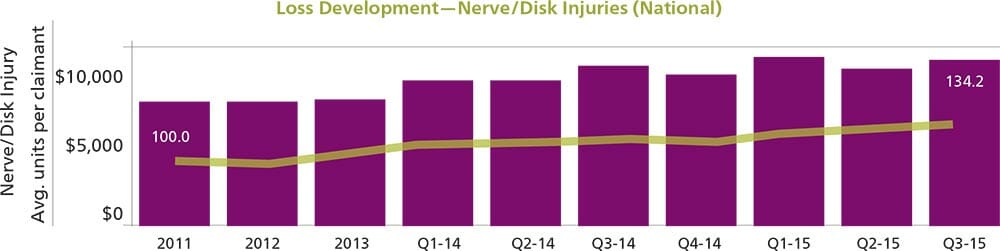

Many of the cost drivers of third party claims are centered on issues related to provider visits and treatments. There’s the new trend of claimants visiting providers more frequently than before, and the overall length of time taken to treat injuries is increasing as well. In addition to more frequent visits, there has also been an increase in providers using costly procedures, like more expensive imaging procedures, such as MRI or CT scans, to diagnose injuries. Not only are injuries becoming more expensive to diagnose, but some have also become more expensive to treat. Providers have been diagnosing more serious injuries more frequently as well. For example, since 2011, there’s been a 34 percent increase in average charge per claimant with nerve or disk injuries while the frequency of this type of injury has increased about 18 percent. One reason for the increase in treatment costs is that providers are now using surgeries and injections as treatment more often than other, less expensive options.  Different areas of the country are currently seeing recommended surgeries as a more common part of third party demands, though this isn’t due to new technology or surgical procedures that help with auto injuries. This is coupled with a trend of increased use of surgeries as standard practice and increased tolerance in certain venues. Not only are all of these different factors driving third party claim costs on their own, but on top of that, providers are charging auto carriers at a higher rate than they are charging other payors. This is most likely occurring because third party insurers don’t have access to networks with lower contracted rates like other payors, including Medicare and group health.

Different areas of the country are currently seeing recommended surgeries as a more common part of third party demands, though this isn’t due to new technology or surgical procedures that help with auto injuries. This is coupled with a trend of increased use of surgeries as standard practice and increased tolerance in certain venues. Not only are all of these different factors driving third party claim costs on their own, but on top of that, providers are charging auto carriers at a higher rate than they are charging other payors. This is most likely occurring because third party insurers don’t have access to networks with lower contracted rates like other payors, including Medicare and group health.

Cases of Fraud

Fraud is another leading driver of rising third party claims. There are a couple of different categories of fraud to look out for. First, there is a trend of providers not only treating pre-existing conditions that are unrelated to the third party claim, but also using more expensive procedures, like surgeries or nerve treatments to do so. Second, some attorney-represented claims are falling victim to “the build-up model,” which is a term used to describe what happens when attorneys direct treatment in a particular (self-serving) way. For example, an attorney could refer a claimant to a medical provider who he has a relationship with. Though that claimant was initially diagnosed at the hospital with a soft tissue problem, they might end up getting treated for it at the chiropractor who refers them to an expensive orthopedist. The orthopedist then recommends injections or surgery for this minor injury even though such treatment recommendation deviates from the standard of care. This recommendation then increases the value of the demand request, so the attorney ends up asking the insurance company for more money even before the procedure occurs. Many times, the claimant doesn’t end up getting the surgery, resulting in pure profit for the attorney and claimant and causing the insurance company to pay much more than the fair price for that claim. Only a small percentage of claims might result from attorneys participating in the build-up model, but when they do, the results can be extremely costly for insurance companies.

Adjuster Struggles Inside the Claims Process

Finally, there are a few factors affecting third party claim costs that are within the insurance company’s claims process itself. Claims with attorney representation pose additional challenges for adjusters. There is a general consensus among carriers that the number of represented claims is growing, which is concerning because attorney represented claims are much more complex than unrepresented claims, since attorney representation adds in an extra step of negotiation. Further complicating this aspect of third party claims is that adjusters often have to deal with daunting demand packages. The demands that are presented are frequently disorganized, include poor-quality images and duplicate billings. Adjusters are typically already extremely busy. With a lot of work on their plate, it is difficult for them to find the time required to sort through demand packages and organize them in the best way so that they can negotiate the claims to the fairest price. Disorganized demands already make negotiations and the third party claim process a pain point for adjusters. But to make that even worse, recently, negotiation training has fallen by the wayside at many insurance companies. As a result, adjusters aren’t trained to consistently use the best practices to negotiate with attorneys on demands, leading to less successful negotiations—which means insurance companies are more frequently overpaying on third party claims. <h2 Third party auto claims are different than first party claims since there aren’t as many defined standards of payment and because claims are typically settled in chunks instead of by individual medical bills. Because of this and a lack of fee schedules in third party, it’s tough to get every adjuster to consistently come up with accurate values across similar claims. Inconsistency stems from two major areas: liability assessment and injury evaluation.

Liability Assessment

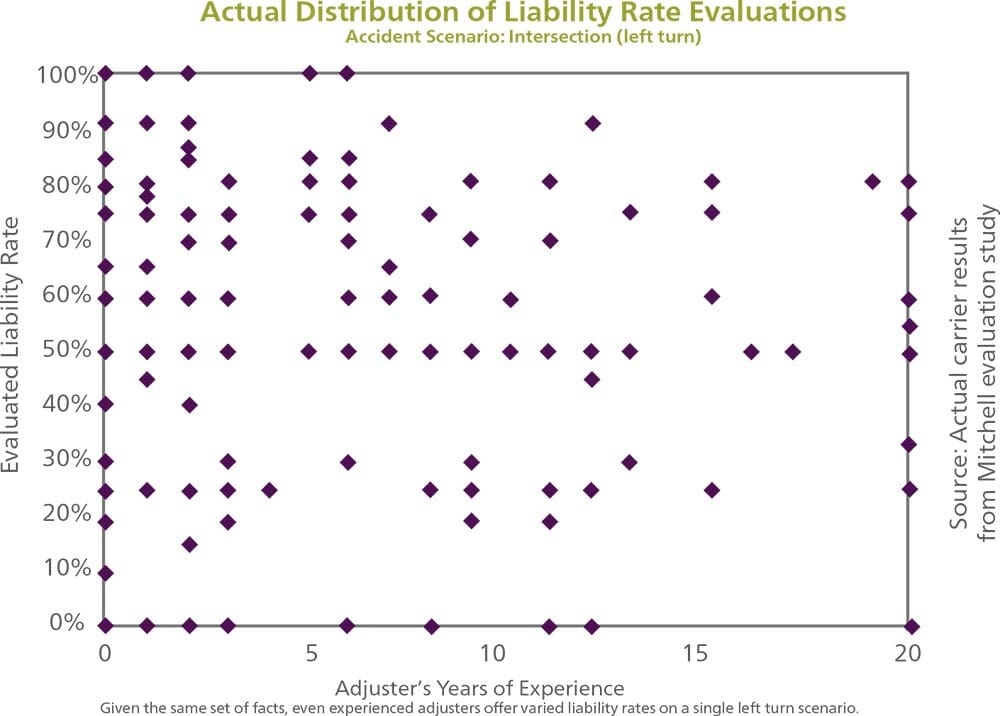

Without any tools in place, adjusters frequently use different methods to assess liability. In a customer study, Mitchell documented this adjuster inconsistency in assessing liability third party claims. A variety of adjusters from a specific carrier, with experience ranging from zero to 15+ years, were given the same set of facts for an accident involving a left turn at an intersection and asked to perform a liability assessment. Though they were given the same information, the liability rates the adjusters came up with were different across the board. Even the group of adjusters in the category of 15+ years of experience category came up with different answers than each other. This variation demonstrates the major consistency problem adjusters are facing when assessing liability—even with years of training and practice, adjusters struggle to settle claims consistently with their peers. Inconsistent claims adjusting means insurers are either frequently overpaying or underpaying on claims. While paying more than the accurate price is obviously problematic for insurers, underpaying can result in litigation that often ends up unnecessarily driving up settlement costs.  The root cause of this problem stems from a few different areas. One reason for inconsistency could be that while the company’s methods and liability assessment techniques are documented, they might not be fully integrated within the claim system or adjuster computing workspace. An example of what this gap might look like is a series of Post-it Notes explaining the procedure around the adjuster’s desk. If companies don’t have their adjusting requirements integrated into their third party claims adjusting process, then it’s easy for one adjuster to forget to make certain changes or interpret guidelines in a different way than the next adjuster.

The root cause of this problem stems from a few different areas. One reason for inconsistency could be that while the company’s methods and liability assessment techniques are documented, they might not be fully integrated within the claim system or adjuster computing workspace. An example of what this gap might look like is a series of Post-it Notes explaining the procedure around the adjuster’s desk. If companies don’t have their adjusting requirements integrated into their third party claims adjusting process, then it’s easy for one adjuster to forget to make certain changes or interpret guidelines in a different way than the next adjuster.

Injury Evaluation

Another reason for inconsistency is that injuries are being evaluated by adjusters who aren’t using tools to support them in the process. Many times, the threshold of how much money an adjuster can spend on a claim, which is determined by a supervisor, shapes the way an adjuster looks at a claim. In this scenario, adjusters may try to keep their settlements under that threshold, and decide to cut or allow medical treatments only based on keeping the cost under that number instead of evaluating based on best practices. Since there are usually multiple different supervisors at one company, there can be a wide distribution of all of the payouts with a wide gap between the lowest and highest payouts. This gap could lead to increased litigation for insurance companies.

Challenge 3: A New Generation of Adjusters

The consistency problem insurers are facing in the third party market could get a lot worse if companies aren’t prepared. About 25 percent of insurance industry professionals are slated to retire by the year 2018, meaning thousands of the industry’s most senior adjusters will walk out the door, taking their industry knowledge and expertise with them. This will be felt more profoundly in third party claims departments since adjuster knowledge is key to reaching accurate settlements and succeeding in negotiations. When many experienced employees leave, companies will have to train many new, younger adjusters which will take time. Third party claims are complicated, and it could take a while for employees who are new to the industry to become experts at their jobs. This could leave insurers with sub-optimal settlements on claims for years. Another factor with the more experienced generation retiring and the new generation entering into the industry is that younger employees are generally more tech savvy. The millennial generation, defined as people born from the early 1980s until about the year 2000, is entering the workforce and bringing their love for technology with them. In fact, a study by the U.S. Chamber of Commerce Foundation found that compared to older generations, millennials are 2.5 times more likely to try out new technologies as early adopters. Millennials are also more likely to use the internet. Millennials want to use the latest and greatest technology to help them get their jobs done efficiently, which contrasts with much of the older generation’s unwillingness to try out new platforms and solutions.

The Solution

To combat these three major issues facing the third party market, it is critical to provide adjusters with expert decision support tools to help them make the best decisions when evaluating third party demands and negotiating settlements. By providing adjusters with a third party solution suite that comes filled with comprehensive, integrated expert technology and services, insurance companies can start to see improved outcomes and more consistent settlements.  Here is an example of a recommended suite of third party tools: medical bill review, liability and injury evaluation, general damages assessment, claims process services, demand package management, medical professional review and direct-to-provider negotiation services. This combination of technology and services covers all of the most important areas of third party claims, allowing insurance companies to increase efficiency and combat rising costs, reduce claim evaluation inconsistency, and the aging workforce.

Here is an example of a recommended suite of third party tools: medical bill review, liability and injury evaluation, general damages assessment, claims process services, demand package management, medical professional review and direct-to-provider negotiation services. This combination of technology and services covers all of the most important areas of third party claims, allowing insurance companies to increase efficiency and combat rising costs, reduce claim evaluation inconsistency, and the aging workforce.

Rising Costs of Third Party Claims

Specifically, in order for insurance companies to combat rising costs based on provider-related charges, they should make sure their bill review process includes benchmarking. By comparing provider charges on auto casualty claims to provider charges for the same treatment in other areas like workers’ compensation or group health, insurance companies can be more confident that they are paying the fairest price on claims—instead of a price that was inflated just because the injury happened in an auto accident. Another important tool to have in an insurance company’s third party toolkit is medical review services. Medical reviewers help verify that insurers are only paying for injuries related to the accident and also aren’t overpaying for treatments. This service can help protect the insurance company from fraud and help identify “the build-up model” as well. For example, a charge might show up on a bill for a treatment on a patient’s shoulder. When a nurse or other medical professional reviews the record, they might realize that based on their professional opinion, the accident wasn’t the cause for the patient’s shoulder injury, and then the nurse can alert the adjuster. In order to get the most value out of a medical professional’s recommendations, this medical review process should be linked with the rest of the company’s solutions. This way, it’s easy to make sure no recommendations are lost or diminished. This helps insurance carriers contain costs by making sure they only pay for treatments the patient actually needs and for injuries that are related to the accident, helping protect them from fraud. Insurance companies should also make sure to provide adjusters with tools to assist them as they negotiate with attorneys. In order to reach the most accurate settlement, adjusters have to successfully negotiate with attorneys, which can be a complicated and difficult process. That’s why it’s valuable to have solutions that provide an organized set of facts to help with the negotiation process. This not only helps drive consistency across adjusters, but also empowers adjusters to negotiate the specific facts of the case, not just a dollar figure. By using medical reviewers, adjusters are assured of having a strong, evidence-based foundation when discussing the merits of their settlement offer. Another great way to improve negotiations is to provide adjusters with liability and generals assessment tools that empower them to settle the claim at the precise amount of liability and negotiate more successfully. These types of solutions provide organized information that can help adjusters explain their decisions to attorneys so that they are completely prepared for the negotiation process. This helps adjusters better explain the investigation and liability assessment process and ultimately results in more consistent, accurate settlements on third party claims.

Inconsistent Claim Evaluation

An efficient way to improve assessment and settlement consistency throughout the claims organization is to take the time to build the company’s strategy into an easy-to-operationalize knowledgebase. A liability assessment and injury evaluation tool can help an insurance carrier improve consistency and manage costs from settling too high or too low by integrating and distributing the company’s knowledge base into adjusters’ daily workflows. A tool that also comes with reporting capabilities can help an insurance company address any problems with inconsistency or overpayment right away instead of waiting a year or two to finally notice that their severity is trending upward. This can help save companies from overpaying or underpaying on settlements over a long period of time. Another area a robust software solution can help insurers improve outcomes is in liability assessment. Without a robust solution, carriers typically have a low rate of claims that are approved for shared liability, meaning they are missing an opportunity for cost containment in situations where liability is shared. A liability assessment tool can help companies improve their approved liability averages while also increasing their shared liability averages across the board. This helps enable consistency in liability evaluation which improves accuracy, helps manage costs and improves third party outcomes. A good solution can also enable adjuster independence while providing guidance to them where needed. If a company can prove its methodology and can show that it has paid the same price on similar claims on every instance, they can have a better chance of winning any lawsuits that could come their way. By using an assessment and evaluation solution correctly, companies can see major improvements in consistency and optimize their medical spend.

A New Generation of Adjusters

One of the most helpful pieces of a third party solution suite to ease the human resource transition is a liability and injury assessment tool that incorporates the best practices and knowledge that retiring adjusters will be taking with them. By capturing the company’s knowledge and culture within its workflow, companies can easily apply it across the organization even after all of its most experienced adjusters have retired. One example of what to build in to the software system is the best practices that their adjusters are using in the field to negotiate with attorneys. With the millennial generation entering the workplace and naturally taking to new technology, now is the time to start considering how using more of the latest technology in the claims process can improve outcomes. By implementing advanced software solutions that will help adjusters learn and do their jobs quicker and more efficiently, companies can better match the millennial desire for using technology at work. For example, in assessing third party claims, new adjusters need to learn the best practices for negotiating with attorneys. A great way to assist them is to use a technology solution that’s integrated with the investigation and liability process, which simplifies the most important negotiation points into a table or list. By implementing friendly, effective and easy-to-use software solutions, companies can attract more of the technology-loving millennial generation to fill the gap it will be facing in a few years.

Conclusion

Choosing to work with an experienced partner that offers a complete, integrated suite of products and services specifically targeted to the unique needs of the third party market is an easy way for insurance companies to manage all of the knowledge and tools adjusters need to successfully settle claims and manage costs. A partner that offers an integrated solution set is a great choice, since the integration ensures that no parts of the process get lost. When adjusters are empowered to make great decisions and their claims management system works seamlessly with bill review, medical review, liability assessment and all of the other steps in the claim life cycle, the insurer can consistently pay the most accurate price on claims.