Workers’ Comp Data: About 25% of COVID-19 Claims Have Associated Medical Costs

Data analysis by Aarthi Thiruvengadam. In 2020, the workers’ compensation industry endured many changes due to the COVID-19 pandemic, including major changes in the frequency, type and source of reported claims. Last summer, Mitchell published a report that showcased some of these changes through the first half of the year. Now that the year has come to a close, we took a closer look at Mitchell’s workers’ compensation claim data throughout all of 2020, and below, we’ll share our key claim takeaways.

Key Findings

After reviewing the workers’ compensation claims data from January 1, 2020 through December 31, 2020, a few major trends stand out:

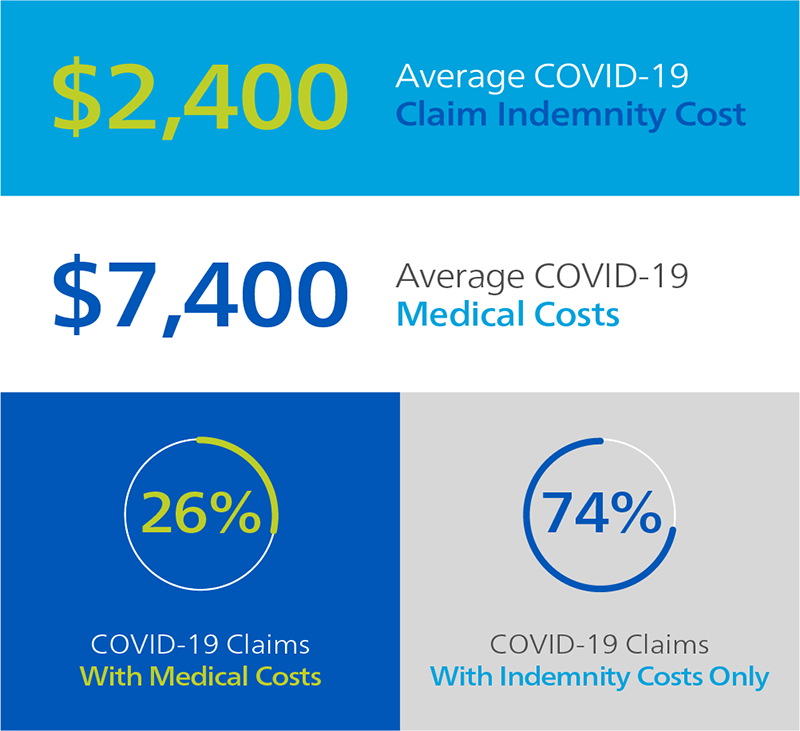

- Only one-quarter of all COVID-19-related workers’ compensation claims in 2020 incurred medical costs; the other 75% of COVID-19 claims only included indemnity costs. As a result, the average total medical and indemnity cost of a COVID-19 workers’ compensation claim was $4,320.

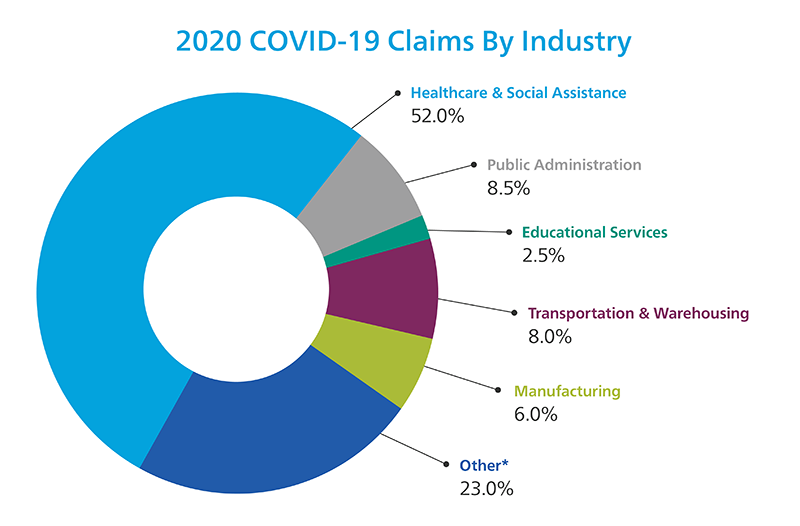

- Employees representing the healthcare industry sector were the largest source of COVID-19-related workers’ compensation claims in 2020—about half of all COVID-19 claims and more than 6 times greater than any other single sector.

- Throughout 2020, the healthcare and transportation and warehousing sectors were the only groups with a major increase in total workers’ compensation claims reported compared to 2019—both experiencing a 24% bump. Most other industry sectors experienced a decrease in the total number of claims.

About One-Quarter of COVID-19-Related Workers’ Comp Claims in 2020 Incurred Medical Costs

Based on Mitchell’s workers’ compensation claims data, we found that only a quarter of COVID-19-related workers’ compensation claims incurred medical costs; the other three-quarters of COVID-19 claims only incurred indemnity costs. Medical costs associated with COVID-19 claims were about $7,400 on average—more than 3 times as much as COVID-19-related indemnity costs, which came in at $2,400 on average. In total, considering that only about a quarter of claims included medical costs, the average total indemnity and medical cost of COVID-19-related claims was $4,320. This data aligns with other findings around the industry. For example, according to FairHealth, while the average cost of a COVID-19-related hospital stay is $73,300—much higher than the average workers’ comp COVID-19 claim cost—only 15-20% of people who seek treatment for COVID-19 actually require a hospital stay.

The Healthcare Industry Continues to be the Source of the Majority of Workers’ Compensation COVID-19 Claims

In 2020, the healthcare and social assistance industry sector was the source of 52% of all COVID-19-related workers’ compensation claims. As the graph above demonstrates, public administration is the industry sector with the second highest number of COVID-19-related claims, making up only 8.5% of the total. Again, as we reported midway through 2020, the data continues to align with what you would expect as healthcare workers continued to fight the pandemic from the frontlines throughout the year. Though healthcare does make up a significant majority, the portion of COVID-19 claims stemming from the healthcare industry ended the year at a lower rate when compared to just the first six months of 2020—in July of last year, Mitchell reported that the healthcare industry was the source of 66% of COVID-19 claims. This could be attributed to the loosening of COVID-19 restrictions in many jurisdictions around the country at times during the second half of 2020 when cases were lower in some areas, allowing other industries to resume business. As the pandemic continues, we expect the mix of industries contributing COVID-19 claims to continue to shift slightly as regulations change around the country and vaccines roll out.

Healthcare and Transportation and Warehousing Experienced Most Significant Increase in the Total Number of Workers’ Compensation Claims; Most Other Industries Saw Decline

In 2020, the healthcare and transportation and warehousing industry sectors were the only groups that experienced a significant increase in the number of total workers’ compensation claims submitted, both respectively showing a 24% bump compared to 2019. All other major sectors, including manufacturing, construction, retail and others, experienced a decrease in workers’ compensation claims in 2020. The accommodation and food services industry experienced the largest decline, with a 36% reduction in workers’ compensation claims compared to 2019. As healthcare workers fought on the front lines and reported the most COVID-19 workers’ compensation claims compared to any other sector throughout the pandemic, it makes sense that this industry saw an increase in the number of claims reported. Same with transportation and warehousing, as online retail also saw major volume increases in 2020. On the other hand, many other industries were forced to stop in-person operations or close down temporarily, which accounts for the decrease in those sectors. In 2021, as the COVID-19 vaccine rollout continues, it is currently difficult to predict if these numbers will even out and adjust back to normal levels at some point this year.

Our Data

The data in this article is an aggregate of Mitchell statistics from workers’ compensation claims from January 1, 2020 through December 31, 2021. Industries were identified as per the two-digit North American Industry Classification System (NAICS) code classifications. *Other category contains: Agriculture, Forestry, Fishing and Hunting, Mining, Quarrying, and Oil and Gas Extraction, Utilities, Construction, Wholesale Trade, Retail Trade, Information, Finance and Insurance, Real Estate and Rental and Leasing, Professional, Scientific, and Technical Services, Management of Companies and Enterprises, Administrative and Support and Waste Management and Remediation Services, Arts, Entertainment, and Recreation, Accommodation and Food Services, Other Services (except Public Administration). **The Transportation and Warehousing sector, while not one of the top contributors to claim volume, also experienced a 24% increase in claim volume in 2020.