Using Integrated Solutions to Help Improve The Workers Compensation Claim Process

From the moment an injury occurs, to the day an injured worker returns to work, the journey a workers’ compensation claim may take is complex, involving numerous parties and diverse jurisdictional requirements. Adding to the complexity are the number of stakeholders interested in the claim outcome but working in disparate technologies: First and foremost the injured worker, but also the employer, the insurer and the provider. Balancing the interests of each stakeholder in a claim can prove challenging, but that balance can be achieved by leveraging integrated technology to facilitate good communication and manage risks.

Integrated solutions help deliver better outcomes for all stakeholders involved in the claim.

With so many parties interested in the claim, it is easy to see how outcomes can be challenged by competing influences. However, it is imperative to align motivations by the singular question: “How can we best restore this injured worker’s life?” The key to aligning these motivations really boils down to better communication—communication between people and communication between systems. When an insurer has a robust claims management system fully integrated with managed care, pharmacy benefit management, network optimization and bill review, better outcomes can be achieved for all stakeholders in the claim.

Joel was a long-term employee at a cable provider where his main duty was installations at customers’ homes. One afternoon, while moving boxes out of his van, Joel heard a pop in his shoulder and immediately felt pain. Since it was almost the end of his shift and his doctor’s office was on the way back home, Joel decided to drive himself to his doctor’s office. After an x-ray and full examination, Dr. South diagnosed him with a potential torn rotator cuff in his left shoulder and requested an MRI to get a definitive diagnosis. Dr. South prescribed an opioid for the pain and a notice that Joel must refrain from any physical activity at his place of work. Joel returned home after picking up his prescription. He then called his employer to notify them of the situation. In a matter of hours, a workers’ compensation claim was opened. The team who will assist Joel in his recovery process and return to work is beginning to assemble including his employer, a provider and a pharmacy. In addition, the insurer receives notification and assigns a claims adjuster to Joel’s claim.

Joel was a long-term employee at a cable provider where his main duty was installations at customers’ homes. One afternoon, while moving boxes out of his van, Joel heard a pop in his shoulder and immediately felt pain. Since it was almost the end of his shift and his doctor’s office was on the way back home, Joel decided to drive himself to his doctor’s office. After an x-ray and full examination, Dr. South diagnosed him with a potential torn rotator cuff in his left shoulder and requested an MRI to get a definitive diagnosis. Dr. South prescribed an opioid for the pain and a notice that Joel must refrain from any physical activity at his place of work. Joel returned home after picking up his prescription. He then called his employer to notify them of the situation. In a matter of hours, a workers’ compensation claim was opened. The team who will assist Joel in his recovery process and return to work is beginning to assemble including his employer, a provider and a pharmacy. In addition, the insurer receives notification and assigns a claims adjuster to Joel’s claim.Providing the Right Amount of Care through Data

Adjuster workloads continue to increase making it more difficult for adjusters to monitor every aspect of their claims. Yet, the tools at an adjuster’s disposal are becoming increasingly more sophisticated. Data analytics and clinical edits embedded within an effective workflow help guide claims along the right path. The flexibility to adjust the course of the claims journey helps the adjuster ensure the injured worker is getting the right amount of care and creating a better claims outcome overall.

Joel visited Dr. South a few days after the accident for a follow-up. Dr. South suggested some ways that Joel could expedite his healing, including physical therapy. Joel mentioned that his right wrist had also been giving him trouble since he fell off a ladder repairing his roof at home. Dr. South decided that both his shoulder and his wrist could benefit from physical therapy. As the insurer began to receive medical bills from the physical therapist, clinical edits triggered an additional review of the bills. The adjuster determined that the wrist injury was not a work-related injury, and therefore not compensable. The adjuster made an appropriate decision to pay the therapy bills related to the shoulder and deny the rest.

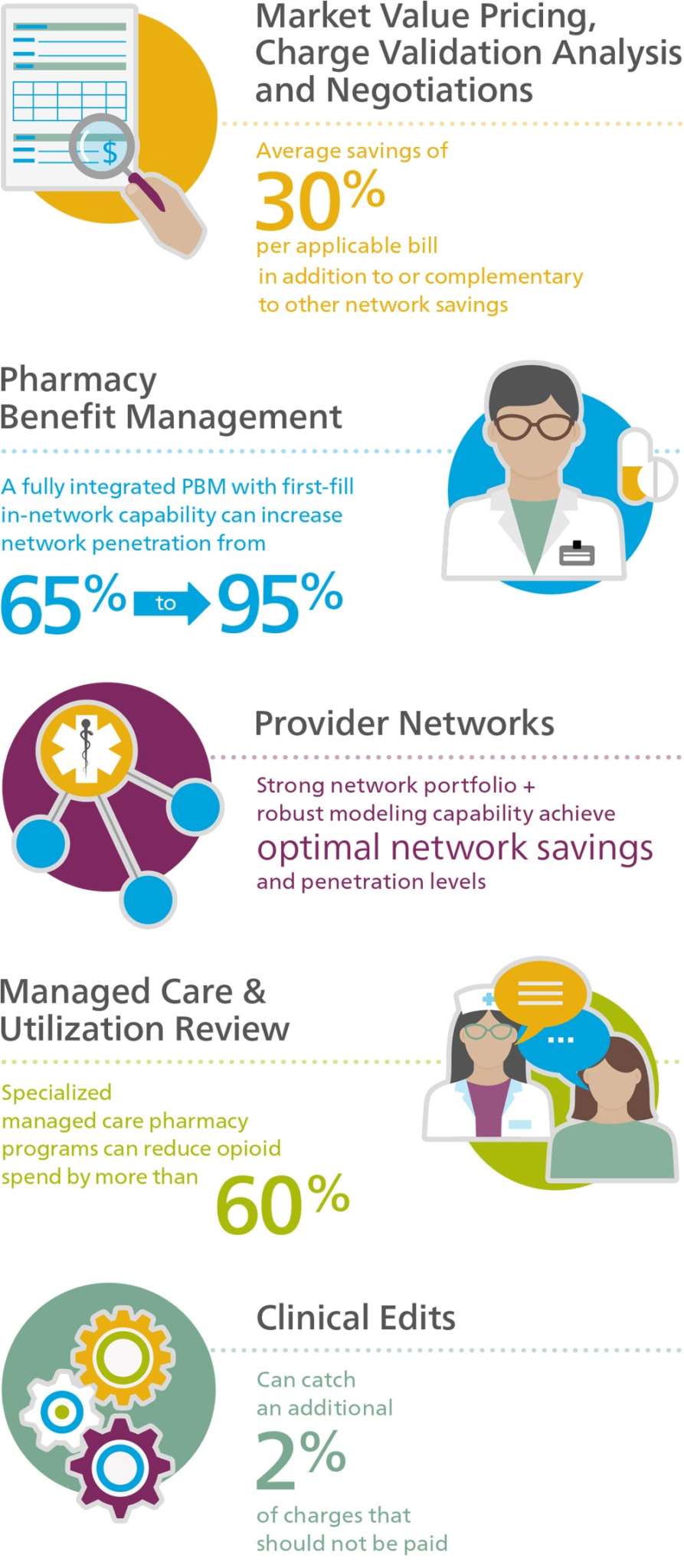

Joel visited Dr. South a few days after the accident for a follow-up. Dr. South suggested some ways that Joel could expedite his healing, including physical therapy. Joel mentioned that his right wrist had also been giving him trouble since he fell off a ladder repairing his roof at home. Dr. South decided that both his shoulder and his wrist could benefit from physical therapy. As the insurer began to receive medical bills from the physical therapist, clinical edits triggered an additional review of the bills. The adjuster determined that the wrist injury was not a work-related injury, and therefore not compensable. The adjuster made an appropriate decision to pay the therapy bills related to the shoulder and deny the rest.For example, by inspecting First Report of Injury data, diagnosis data or first-fill prescription data, adjusters can identify claims early that may require extra attention such as nurse case management, utilization review or even pharmacy intervention. By embedding medical treatment guidelines in the workflow, claims can be programmatically flagged where treatments fall outside recommended guidelines. Clinical edits that identify these outlier billing conditions can increase cost efficiencies over all claims by 2 percent.1 Not only does this help insurers contain costs by avoiding payment of potentially excess treatment, it also helps injured workers get the right level of care at the right time. Failure to leverage data assets such as analytics and clinical edits can cause claims administrators to miss opportunities to redirect claims. Integrating these tools in the workflow puts smarter tools in the hands of the adjusters, improving consistency in decision-making and preventing over-payment of bills.

Integrated Solutions Lead to Optimal Outcomes

Data Integration with Pharmacy Benefit Management (PBM)

First-fill prescriptions are notoriously costly. Hundreds of dollars can be spent on a claim before an insurer ever receives notification of the claim. An integrated PBM with first-fill in-network capabilities can reduce the insurer’s pharmacy spend by redirecting the prescription in-network when it otherwise would have been filled out-of-network. A typical PBM solution might reach network penetration levels of 65 percent, yet insurers with a tightly integrated PBM with first-fill in-network capabilities can see far greater penetration, as high as 95 percent.2

On the same day that the injury occurred, Joel went to the pharmacy to fill his prescription. He told the pharmacist that the prescription was related to an injury he received at work and he was not sure how he was supposed to pay for the prescription. The pharmacist knew exactly what to do. She was able to provide Joel with his prescription with no out-of-pocket costs.

On the same day that the injury occurred, Joel went to the pharmacy to fill his prescription. He told the pharmacist that the prescription was related to an injury he received at work and he was not sure how he was supposed to pay for the prescription. The pharmacist knew exactly what to do. She was able to provide Joel with his prescription with no out-of-pocket costs.Additionally, a strong clinical program is an important component of managing this very risky part of a claim. According to Dr. Mitch Freeman, PharmD and Chief Clinical Officer at Mitchell, an integrated PBM solution helps to “successfully navigate the risks along the claim journey by monitoring potential roadblocks or pitfalls, identifying when any suboptimal or dangerous treatment pathways are taken, and intervening with the prescriber to keep drug therapy on an appropriate path.”3 Data integration also helps to solve a common pain point for adjusters: getting a full view of the claim. Getting the full claim view often requires visiting a variety of systems, each containing differing pieces of data related to the claim. One system may contain medical bills, while another contains pharmacy benefits and yet another shows utilization review and nurse case management activity. As an industry, if we are ever going to curb the rising costs of pharmacy and the opioid epidemic, we are going to have to provide better data to those making the day-to-day decisions on the claim—the adjusters. A deep integration between PBM, medical bill review and pharmacy intervention will not only provide better outcomes for injured workers, but also a solution that is best positioned to contain the rising costs of pharmacy.

Utilization Review Integration

UR and other case management programs can provide much needed support for the injured worker and for providers. With pharmacy costs accounting for 17 percent of the cost of claims,4 UR can reduce pharmacy spend by determining if the prescribed medications are the best option for the injured worker. Insurers can see more than a 60 percent reduction in opioid spend by integrating specialized managed care pharmacy programs to help mitigate serious risks and exorbitant spend.5 More importantly, if an injured worker is prescribed opioids to assist in the recovery process, pharmacy intervention through a nurse case manager can monitor and ensure appropriateness of ongoing prescriptions. These types of proactive clinical care can ensure that claimants receive the treatment they need and right level of care.

Joel’s case was assigned to Utilization Review (UR). Sarah, the nurse performing the UR, reviewed Joel’s records and his physician’s treatment plan, and identified a few aspects that caught her eye. She noted that Dr. South prescribed 12 physical therapy visits. After consulting medical treatment guidelines, Sarah determined that the 12 visits may be excessive. After consulting a physician advisor, she recommended that Joel receive eight physical therapy visits.Sarah also noted that Joel was still being prescribed opioids. She referred the case to a pharmacy intervention nurse, Barbara, for review. After Barbara reviewed the case with Dr. South, they were able to agree on an alternative medication instead of the opioid to reduce the risk of Joel becoming opioid dependent.

Joel’s case was assigned to Utilization Review (UR). Sarah, the nurse performing the UR, reviewed Joel’s records and his physician’s treatment plan, and identified a few aspects that caught her eye. She noted that Dr. South prescribed 12 physical therapy visits. After consulting medical treatment guidelines, Sarah determined that the 12 visits may be excessive. After consulting a physician advisor, she recommended that Joel receive eight physical therapy visits.Sarah also noted that Joel was still being prescribed opioids. She referred the case to a pharmacy intervention nurse, Barbara, for review. After Barbara reviewed the case with Dr. South, they were able to agree on an alternative medication instead of the opioid to reduce the risk of Joel becoming opioid dependent.Without the proper clinical oversight, a workers’ compensation claim can quickly become unnecessarily costly to the insurer and, more importantly, create excessive care for the injured worker. Outcomes can further be improved by integrating UR decisions into bill review. Jackie Payne, Vice President of Medical Management Services at Mitchell, explains that, “Collaborations between bill review and managed care, two typically ‘siloed’ work streams, can provide insights into an 'at-risk' claim,”6 which in turn helps curb costs and provides the right level of care to the injured worker.

Provider Networks

Provider networks not only help injured workers receive quality care, they also play a key role in an insurer’s cost containment solution both prospectively and retrospectively. As shown in Joel’s example, when an injured worker is treated within the preferred provider network, both the level of care and costs associated with the treatment improve the overall outcome of the claim.

Throughout the course of Joel’s treatment, provider networks have played an important role, and in some cases a direct role, in the care that he received. For example, since the workers’ compensation claim was in process at the time Joel was prescribed physical therapy, the payor was able to refer him to a physical therapist within the preferred provider network.

Throughout the course of Joel’s treatment, provider networks have played an important role, and in some cases a direct role, in the care that he received. For example, since the workers’ compensation claim was in process at the time Joel was prescribed physical therapy, the payor was able to refer him to a physical therapist within the preferred provider network.In order to truly maximize cost containment, it is imperative for an insurer’s bill review platform to have an optimized network solution. Optimal network penetration is achieved with a strong network portfolio combined with robust modeling capability. The breadth and depth of a network portfolio is just as important as having flexibility to adjust the network stack. Lee Haripko, Senior Director of Strategic Partners at Mitchell, states, “The hierarchy of the networks and cost containment solutions have a tremendous impact on penetration rates,…[savings], and turnaround times.”7 Modeling capabilities are especially beneficial when utilizing specialty bill review solutions such as market value pricing and charge validation analysis in addition to standard provider networks. In certain instances, by placing these early in the network hierarchy, insurers can achieve an average of 30 percent greater cost containment in addition to or complementary to other network savings.8

Conclusion

Joel’s pharmacy intervention nurse, Barbara, continued to stay close to Joel and Dr. South throughout his recovery. Joel was able to return to work for light duty after three weeks as he continued his physical therapy. At 12 weeks, he saw Dr. South again. Dr. South was pleased with his progress and Joel was able to return to full, unrestricted duty.

Joel’s pharmacy intervention nurse, Barbara, continued to stay close to Joel and Dr. South throughout his recovery. Joel was able to return to work for light duty after three weeks as he continued his physical therapy. At 12 weeks, he saw Dr. South again. Dr. South was pleased with his progress and Joel was able to return to full, unrestricted duty.A workers’ compensation claim journey often involves numerous parties and complex technologies, but it doesn’t have to be that way. The solution to the challenges facing our industry will need to include an optimized provider network strategy to improve savings for the insurer, integrated managed care and PBM programs that facilitate better care for the injured worker and tighter integrations that enable better communication among systems and among all parties to the claim. By leveraging each of these important technologies, our industry will be positioned to achieve better outcomes for employers, providers and most importantly for injured workers.