Success Story: New AI Model Helps CCMSI Seal the Cracks in the Claims Cycle

Download a PDF Version of this Article CCMSI, a large boutique third party administrator (TPA), has been providing innovative risk management solutions to thousands of companies for more than 40 years. As artificial intelligence (AI) began emerging, CCMSI was early to adopt, and over the last several years, they developed an AI-driven intervention model that has been implemented with tremendous success. This new model had a simple goal: Use AI to flag at-risk claims for adjusters and ensure nothing falls through the cracks throughout the claims process.

Leveraging Historical Data to Build a Forward-Looking Model

While they had been monitoring AI applications for years, CCMSI’s new model truly began in 2013 when they started studying the impact of comorbidity factors on a claim. Through that analysis, they discovered that two or more comorbidity factors could increase the claim’s complexity by as much as 10 times. This defining insight led them to think further about the other factors that might have major claim impacts.

They quickly began creating a plan of action, and in 2015, were on their way to a game-changing solution. They hypothesized that if they could expand their data mining capabilities and use AI to identify impact factors, then automatically alert adjusters, a significant amount of time and energy could be saved, allowing them to focus more intently on what they do best: help claimants get back on the job safely and quickly.

Turning Shorthand Adjuster Notes into Mineable Data Fields

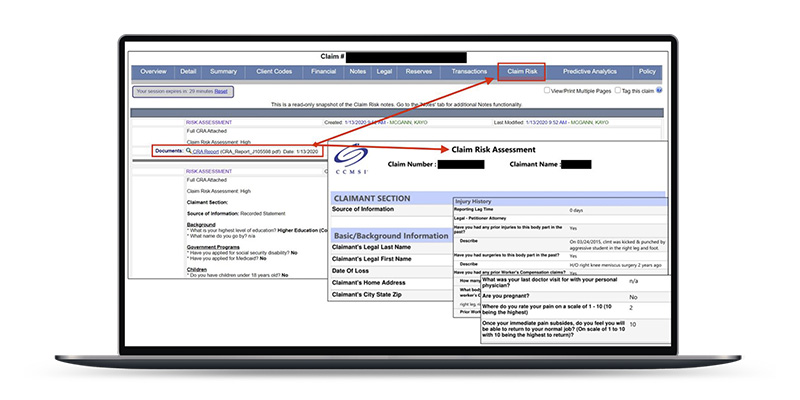

At the beginning of the model’s development, CCMSI soon realized that many factors in a claim were written in the adjuster’s notes, and therefore, not mineable data. To address this they developed a “Claim Risk Analysis” program, which allowed them to increase their data fields and track almost 80 additional claim elements that were formerly written in the notes. With these new fields in place, they were able to quantitatively analyze many more human-related elements of the claimant’s case, such as their mood during communications, their enthusiasm for returning to work and their punctuality for appointments.

At the beginning of the model’s development, CCMSI soon realized that many factors in a claim were written in the adjuster’s notes, and therefore, not mineable data.

Based on these claim elements, algorithms scored each claim with high, medium or low-risk drivers. The collected data could then be used in the model to assist adjusters, supervisors and clients in managing claims and communications to drive the best outcomes for all.

Turning a Wide Net of Data into an Automated Communications Platform

With their new wealth of mineable data, CCMSI began looking at the steps within the claims cycle where automated intervention could have the biggest impact. According to Skip Brechtel, CCMSI’s CIO, “We were looking to identify claim drivers and costs as early as possible. We wanted to extract and apply relevant information, identify high-risk claims quickly and automate certain tasks in order to provide a higher level of confidence for both adjusters and clients, while facilitating better outcomes for all involved parties.”

"We were looking to identify claim drivers and costs as early as possible. We wanted to extract and apply relevant information, identify high risk claims quickly and automate certain tasks in order to provide a higher level of confidence for both adjusters and clients, while facilitating better outcomes for all involved parties." - Skip Brechtel

Turning Solution-Driven Insights into a Visionary AI Model

In order to make the model truly impactful, CCMSI needed to understand the key drivers that would have the greatest impact on ROI for their customers and were most beneficial to claimants. According to Skip, once the hypothesis was constructed, “We were then able to leap into modeling and create and test internal algorithms. Our calculations essentially said the ROI would come in the form of time-savings for adjusters and faster back-to-health for the claimant. We were projecting this could significantly lighten case manager workload. More importantly, we knew if we didn’t do it, someone else would.” In late 2018, CCMSI initiated a search to find a strategic partner that had leading AI tools that could score claims daily based on any changes that occurred during the life of the claim. They wanted a solution that could provide both the claims administration team and their clients with up-to-the-minute information and cost estimates based on the most recent claims information. CCMSI selected Gradient AI to pilot a comprehensive AI-assisted daily claims risk analysis.

Perfecting the Pilot is More Than Half the Battle

The pilot program was designed to last approximately six months. During the pilot, both clients and their claims teams grew more and more comfortable with the data, analytics and the AI assistance. Both parties looked at this program as providing a new and unbiased set of eyes assisting them to manage the entire claims program. The results of the pilot were very encouraging, as the overall variances between adjusters and the predictive models were within 5% to 10% of estimated total exposure.

The results of the pilot were very encouraging, as the overall variances between adjusters and the predictive models were within 5% to 10% of estimated total exposure.

On the claimant side, the pilot results were also very beneficial. Not only could claim changes be dealt with faster and more accurately, medical treatment plans could be altered to help speed up recovery times. For example, if the AI predicted that there was a high potential for future surgery, adjusters could avoid following the conventional wisdom of a claimant being treated for 8-12 weeks first and then advancing to surgery. With a wealth of data as backup, the claims team can recommend the most appropriate course of action on a faster timeline. This not only speeds up the healing process, it decreases frustration and can get claimants back to work faster.

With a wealth of data as backup, the claims team can recommend the most appropriate course of action on a faster timeline. This not only speeds up the healing process, it decreases frustration and can get claimants back to work faster.

Successful Results That Speak for Themselves

By adding the new AI intervention notifications, CCMSI adjusters have new tools and data that can support timely decisions and supporting services that can have a positive impact on both the claimant and client program results. The model is now being used with several CCMSI customers nationwide, and is driving exceptional results. According to Skip, “Right now we think AI is presently preventing claims from falling through the cracks. We get daily predictions on every claim. We're looking for variances between what our adjusters have evaluated the claim to be, and how the AI basically scores the claim. Where there's a variance we want our adjuster and supervisor to review that.” So far, the AI has been able to beat the accuracy of legacy analytics by 30%.

"Right now we think AI is presently preventing claims from falling through the cracks."

CCMSI’s success shows how AI can be harnessed to help carriers and claimants alike. They are excited to introduce it to more customers and to continue thinking outside-the-box about how they can improve lives and bottom lines.