No two payors are the same, so their business workflow solutions shouldn’t be identical either. Every insurer or third party administrator knows their business best and needs a workflow solution which adapts itself to their unique business priorities and rules. Now learn the five qualities that make a business workflow work for your business.

1) Customizable and Flexible

Why

It’s important for companies to be able to optimize their workflow to their own specific requirements since every business has different needs. Businesses shouldn’t be limited to a “one size fits all” model. A workflow, or a set of business processes that work together, should be customizable so each business can create a process order that works best for them.

Decision makers need to have complete control over what happens to a bill after it gets imported into the system.

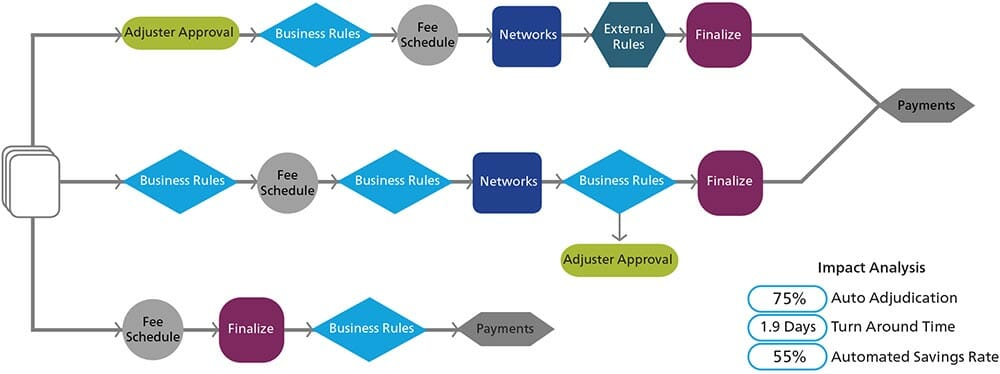

For example, each company should be able to decide at which point in the workflow business rules should be triggered, when bills should be routed for nurse review and adjuster authorization and when to pend and transmit bills for preferred provider organization repricing. Insurers, TPAs and managed care companies shouldn’t be limited to one static, pre-defined process that mandates one process - bills go through bill review, then trigger rules, then go to the PPO network. Decision makers need to have complete control over what happens to a bill after it gets imported into the system.

How

In combination with the workflow solution, the rules engine should allow for complete flexibility in creating business rules in order to get the best outcomes. The rules engine should be separate from the application logic, giving more control to the business user. The engine should be robust enough to allow the user to modify rules as the user requires. This ensures the workflow more closely aligns with the company’s internal guidelines and goals. A large part of having a customizable workflow solution is being able to update it quickly and easily. This includes being able to update business rules within the rules engine in an efficient manner. A rules engine is not as valuable if a company has to contact an external vendor to request rule changes every time it needs a rule modification. This type of approach may take weeks and can be an expensive process.

To help solve this problem, the rules engine must be easy enough to setup, learn and use so that an employee without a development background could master the knowledge required to make and edit rules with minimal training. If payors are able to customize the workflow process to their needs, they are better equipped to develop new ways to ensure cost containment and improve efficiency.

Example

Insurance Company A and Insurance Company B are setting up their business workflows. In particular, they are interested in making sure that their team reviews all high-dollar inpatient hospital bills. It’s also important to them that in their workflow process, utilization review recommendations are applied before the bill goes through the review process. However, Insurance Company B may have no downstream reporting requirements and may set up their business workflow to have upfront adjuster oversight since the bill may be denied and will give their resources more time to process clean bill edits. Both companies have their own specific needs, but Company A and Company B should be able to select a workflow process and rules engine solution which is flexible enough to meet their different business needs. If they are both able to customize their workflow and write rules specific to their needs, both companies are closer to meeting their own business goals.

A large part of having a customizable workflow solution is being able to update it quickly and easily.

Benefits

Using a fully-customized workflow solution sets customers up to produce the best outcomes and gain an edge on the competition in the process. By choosing a scalable and customizable workflow, a company has a greater opportunity to take the subject matter expertise of their best employees and efficiently scale it across the business. If a company can create rules that are tailored exactly to its needs, they can see huge benefits in return. Expert bill review employees can focus on adjudicating more complex bills. Flexible and customizable workflow and rules engine solutions enable insurers and TPAs to have more control over the business, reduce operational costs, write rules that align with company objectives and improve employee productivity.

2) Facilitates Automation

Why

With the right automated process, adjusters don’t need to review each and every bill. A workflow that uses a rules engine can determine which bills require an adjuster’s oversight and which bills can be automatically adjudicated. When a rules engine enables the setup of auto-adjudication within a workflow, it allows the adjusters to focus only on those bills that require an expert decision.

How

Ideal Automation Rate

An efficient workflow usually passes through 60-70 percent of bills automatically. Though each business might shoot for a different rate of automation, a rules engine should allow them to reach this level of efficiency if they choose. A reliable workflow combined with an intelligent rules engine creates a more effective way of performing the bill review process. For example, by establishing rules based on thresholds, treatment codes or document type, bills can be presented to adjusters only when their oversight is necessary. A strong workflow should include business rules that look for exceptions in the data. This capability helps automate tasks that normally required manual processing, and allow the routing of bills to their required destination. Such a combination of reliable workflow and a robust rules engine can run items through the bill review process faster, and more efficiently than a traditional bill review product. It also can help minimize the variances in adjudication decisions that may arise from different skills and experiences.

Example

In order to maximize adjuster efficiency, Insurance Company A doesn’t want employees spending any time on bills that are under $50 or bills that include physical therapy sessions. The rules engine Insurance Company A uses should let them specify these needs and let the identified bills pass through without any human intervention. So when a bill goes through the system for $40, no employee time will be spent approving the payment. Insurance Company A’s adjusters will then have more time to focus on bills that do require their oversight and can give more attention to claims that need further negotiation and investigation. By using a robust workflow and a rules engine that gives Insurance Company A complete control to decide which bills can be automated through the system and which need to stop, the payor is able to improve efficiency.

Benefits

Aside from automating bills adjusters don’t need to work on, an effective workflow/rules engine combination drives down turnaround time. Efficiency will increase, leaving adjusters more time to focus on their core responsibilities. Another benefit of process automation is that it helps the payor stay compliant with timeline-related service level agreements in order to submit payments on time. By making on-time payments, the payor can avoid late-penalties in some states. A rules engine aids in cost containment by checking that providers are billing correctly and helping payors decide what the correct amount is to pay on each bill.

3) Manages Multiple Workflows

Why

A good workflow model should make a complex process easy. TPAs work in a complicated environment because they manage multiple unique businesses that have different requirements and goals. It can get complicated to operate separate workflows for each of their clients. As a result, sometimes TPAs can only offer a single business workflow process across all of their clients, meaning each organization cannot set its own guidelines.

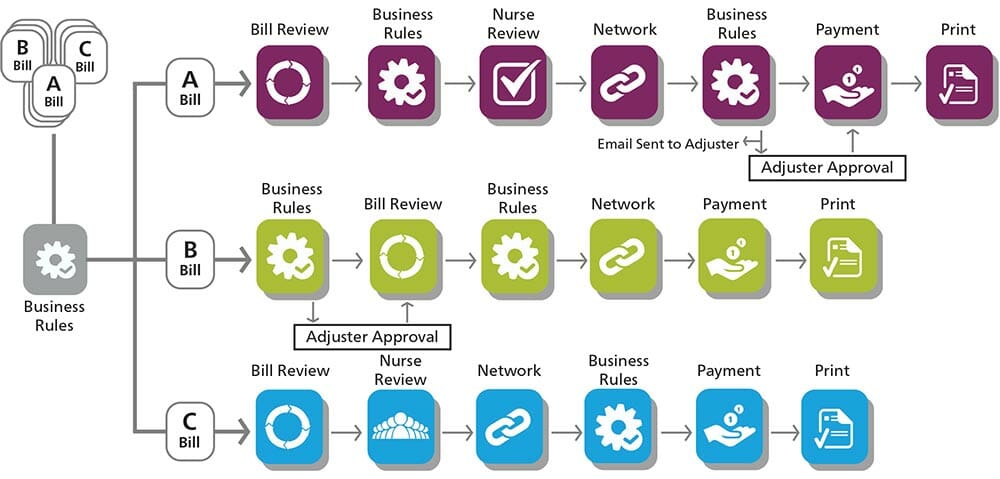

How

TPAs should have a simple way to organize workflows and rule sets separately for each customer. This way, it’s easy for each TPA to ensure they are applying the right business rules and sending medical bills to the right destination for each customer. Without an efficient way to customize and manage multiple workflows and multiple sets of rules, TPAs may lose out to more sophisticated competitors. Solutions that cannot manage multiple customizable workflows and rule sets often cause companies to have to employ more resources and lose out on efficiency savings.

Example

The model that TPAs use should allow for bills to pass through different workflows based on their customer mix. For example, the system should recognize that if a bill comes from Company A, it should run through Company A’s workflow, while a bill from Company B should run through Company B’s workflow and a bill from Company C should run through Company C’s workflow.

Benefits

A system that easily manages multiple workflows improves efficiency, reduces costs and simplifies what could be a complex and confusing process. It allows a TPA to offer a unique service to each of its clients, thus differentiating itself from the competition. Using such a system helps TPAs to efficiently solve problems and produce better outcomes than if they use a “one workflow fits all” model.

4) Connecting to the Value Chain

Why

In order to maximize efficiency, a workflow should not only work seamlessly within its own system, but it should also easily connect to other parts of the business. This scales up all of the advantages of automation throughout the company.

How

Workflows can be complicated, and bills may get stopped during the process, awaiting further action. In order to streamline the process, a workflow and its rules engine should be connected with other parts of the business. For example, a bill shouldn’t leave the bill review system just to get to a nurse reviewer. If the workflow isn’t connected with the nurse review platform, the business isn’t maximizing its efficiency potential. Also, the workflow should be connected to an alerting system for people who work on bills. An adjuster or nurse reviewer shouldn’t be required to constantly check the system to see if there are bills that require attention and/or further action. Employees’ time can be utilized more efficiently when the workflow is set up to alert when it sends a bill out for review.

An adjuster or nurse reviewer shouldn’t be required to constantly check the system to see if there are bills that require attention and/or further action.

Example

Insurance Company A always wants to keep an eye on any closed claims that are being reopened. In order to keep those costs under control, it requires that either Joe or Mary look at any new bills that come through the system that are related to a claim that has already been closed. Both Joe and Mary are very busy, and they don’t have time to continuously check the system to see if there are bills to review. If Insurance Company A has a workflow and a rules engine that are connected externally, this won’t be a problem. It will be able to create a rule that says: “If a bill is related to a closed claim, email joe@insurancecompanyA.com and mary@insurancecompanyA.com for review.”

Now, Joe and Mary are able to spend less time manually checking the system and more time working on their other duties. Insurance Company B frequently uses nurse reviewers, but has noticed that often, nurses’ recommendations aren’t being applied during the bill review process. Insurance Company B uses a homegrown workflow system. It’s losing money on every bill since nurse recommendations are not being applied, all the while the company is still paying for the nurses’ time. Once they realized the problem, Insurance Company B switched to a workflow solution that integrates with their nurse review platform. Now, the nurses’ suggestions are automatically applied to every bill when it goes through the company workflow. By switching over to the robust, enterprise-grade solution, Insurance Company B is taking better control of its medical spend and improving efficiency within the nurse review and bill review process.

Now, Joe and Mary are able to spend less time manually checking the system and more time working on their other duties. Insurance Company B frequently uses nurse reviewers, but has noticed that often, nurses’ recommendations aren’t being applied during the bill review process. Insurance Company B uses a homegrown workflow system. It’s losing money on every bill since nurse recommendations are not being applied, all the while the company is still paying for the nurses’ time. Once they realized the problem, Insurance Company B switched to a workflow solution that integrates with their nurse review platform. Now, the nurses’ suggestions are automatically applied to every bill when it goes through the company workflow. By switching over to the robust, enterprise-grade solution, Insurance Company B is taking better control of its medical spend and improving efficiency within the nurse review and bill review process.

Benefits

By integrating the rules engine with other departments and parts of the business, bills get processed more efficiently. It keeps everything in one place, making it quicker and easier for a medical bill to be sent through the system. This ultimately keeps costs low and saves employees time. Also, when a workflow is capable of alerting an employee that a bill is awaiting his or her review, it benefits the company in two ways. First, it allows employees who audit bills as a small part of their job to focus on other tasks when there isn’t work waiting in his or her queue. If they know they’ll be alerted every time a bill requires their attention, then they don’t have to worry about constantly checking in. Second, alerting the employees involved in the workflow speeds up turnaround time and minimizes the chance of a bill pending for an employee to route it to the next step. Connecting the different steps within a workflow with other parts of the company business is an important part in running a productive business.

5) Powerful & Always Improving

Why

A powerful workflow is one that can help companies learn and evolve over time to help improve business outcomes. The workflow and rules engine should be powerful enough to meet just about any business need a company could have. The workflow shouldn’t be restrictive, but instead, it should empower a business to improve its efficiencies and processes. The rules engine should automate the routing, assignment and tracking of work tasks. It should allow payors to create various types of rules, such as decisioning rules, declarative rules that compute values, transformation rules that map and parse data and integration rules that determine the correct system connection to make in each circumstance.

How

One factor that makes workflow modelers and rules engines powerful is the business value it generates for customers. A commercial-grade rules engine or workflow that’s processed hundreds of millions of transactions over its lifetime can provide a lot of value to a business and is an ideal candidate for payors selecting workflow solutions. An important way a rules engine can continue to add value to a business is by giving decision makers workflow process suggestions and rule modifications that they can use to improve their business outcomes. It should also be easy to measure the power of a workflow. The financial and operational benefits of a customized workflow and rules engine should be easily determinable. For example, if a bill was reduced by a fee schedule ground rule, a user and a custom business rule, all three savings categories should be available for impact analysis. The ability to run this type of analysis is also important in evaluating the financial and operational benefits that a rules engine can provide. Workflows and rules should be able to evolve over time to continue improving financial and operational benefits.

Example

A powerful, mature, dependable and smart workflow allows payors to use it with confidence. Companies should be able to easily customize the workflow to flag bills an employee needs to review and alternatively, pass through bills the company decides adjusters don’t need to see. A commercial-grade rules engine gives companies an unlimited amount of opportunities to make specific business decisions resulting in improved efficiency and better business outcomes and providing both financial and operational benefits.

Benefits

A powerful, mature, dependable and smart workflow allows insurers to use it without worries. Companies should be able to easily customize the workflow to flag bills an employee needs to review and pass through bills the company has decided adjusters don’t need to see. A commercial-grade rules engine gives companies an unlimited amount of opportunities to make specific business decisions resulting in improved efficiency and better business outcomes and provides both financial and operational benefits.

Summary

With today’s continuous goal of achieving cost and quality effectiveness, the flexible and customizable rules engine has become an integral part of an efficient business workflow system. When a workflow is powerful and flexible enough to adapt to any business need, it can automatically produce better outcomes and can help companies that process medical bills outperform their distinct business goals while differentiating themselves from their competition.