Liability and Injury Evaluations: Understanding the Two Types of Recommendation Models

Third party bodily injury teams use a number of different approaches and tools to settle claims, but they do share a similar set of goals—settling claims efficiently and accurately. With so many factors at play in the third party claims process, including adjuster turnover, workload, aligning adjusters with management’s objectives, lack of reporting and more, many carriers struggle to achieve these goals consistently across their organizations. Establishing a consistent approach to liability and injury evaluation is foundational to effective bodily injury claim handling. Moreover, implementing this step is vital to consistent and accurate claim negotiations and settlements in practice. Many auto insurance carriers equip their adjusters with a set of tools and guidelines to help them during this stage of the claims process, but without a programmatic approach to assess and calibrate liability and injury across the organization, adjuster teams will likely diverge in their claim handling practices. A liability and evaluation recommendation model can help improve consistency and accuracy, but it may be challenging to understand which type of model is right for you. Below, we’ve outlined some key information to help you get started.

What is a Recommendation Model?

Many carriers provide their adjusters with technology to help them through the liability and injury evaluation process. These technologies collect information about the claim and help create liability and general damages recommendations that adjusters can use to reach a settlement for the claim. For example, depending on the accident details, these types of technology platforms will collect information like:

- Accident scenario (i.e., intersection vs rear end)

- Weather conditions at the time of loss

- Relevant tort factors (speed/control of vehicle)

- Medicals evaluation data (injuries considered or severity/causation factors)

Based on the data collected, the tool will then use its pre-set model to calculate a potential liability evaluation range. It then walks the adjuster through a similar process to arrive at a recommendation for general damages and medical specials.

Does your workflow incorporate the 5 fundamentals of third party claim processing? Find Out Now >

What Types of Recommendation Models are Available?

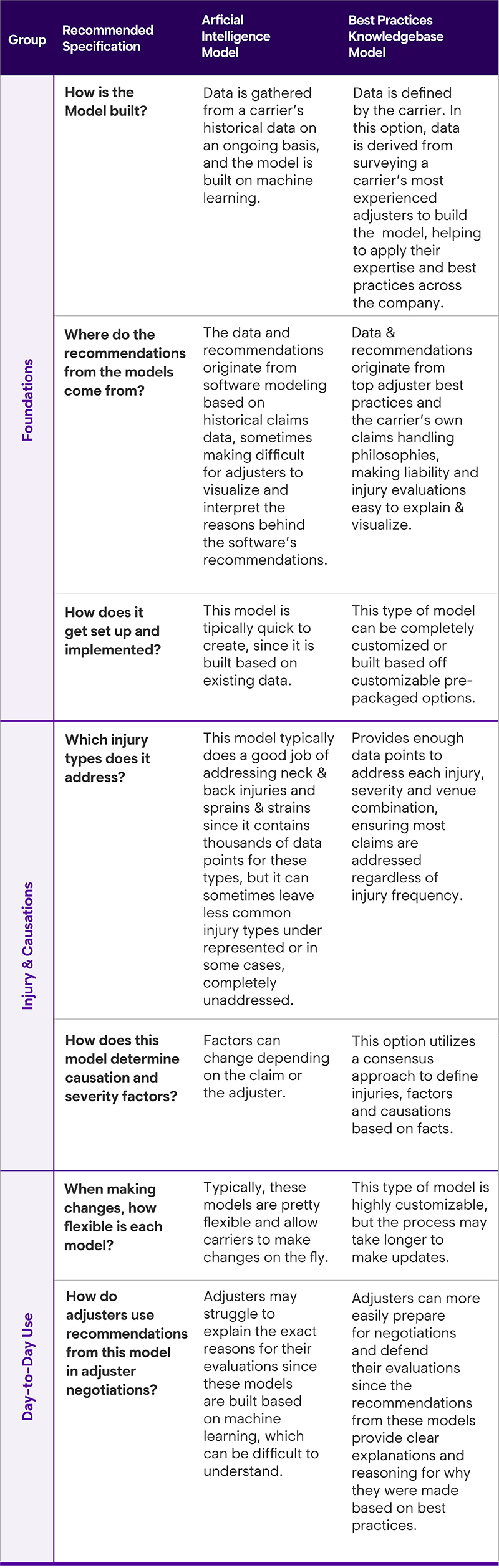

Two types of recommendation models are the most prevalent in the market today: models based off of pure statistical analysis of historic carrier data and models built based on a combination of statistical analysis and on an insurance carrier’s best practices. While both types of models are built with the same purpose in mind—helping auto casualty insurance carriers improve consistency and accuracy in third party bodily injury claim evaluations—we believe the best practices recommendation model provides carriers with a slew of advantages over the historical data model. This type of recommendation or “knowledgebase” model helps carriers establish their own best practices, connect management goals with adjusters’ day-to-day claim handling processes and helps set adjusters up for success in the negotiation process.

Why the Best Practices Model is Right for You

To help you understand in more detail why we believe the best practices model is the best option available in the market, and to help you clearly see the differences between the two types side by side, we’ve outlined the similarities and differences of a historical data model compared to a best practices model.

Interested in seeing a best practices recommendation model in action? Find out more about Mitchell ClaimIQ >

Key Features and Benefits Analysis

As you can see, each type of model brings something different to each insurance carrier. To help easily visualize the differences, we’ve also put together a simple table that highlights the key features and benefits of each type of model.

The Best Practices Knowledgebase Model: Frequently Asked Questions

While it may be easy to understand how a pure statistical model is built based on historical claims data, you may be wondering how the best practices model works and is created. Below, we’ve answered the most frequently asked questions we’re asked about the model.

How Are Best Practices Collected and Entered into the Model?

Typically, the best practices model is developed based on consensus modeling surveys of a carrier’s adjusters, which provides a high degree of data confidence due to the abundance of data points. Carriers select their adjusters to be surveyed to help determine accident scenarios, interview questions, define the tort duties relevant to each accident type, determine severity and causation questions and more.

How Does Surveying My Adjusters Help Create Better Results?

Adjusters are the most important asset a claims handling team has—they carry the knowledge and expertise that help each company succeed. By leveraging the skillsets of the highest performing adjusters to help empower the rest of the claims team, an insurance carrier sets themselves up for consistent and accurate claim evaluations, regardless of the adjuster working on a claim.

What if My Organization Doesn’t Have the Expertise to Build the Models?

Typically, an organization needs seven or more adjusters and other experts to build a best practices knowledgebase model. The model can be built from scratch, or carriers can choose from a starter menu of investigation and injury questions, liability duties and more to help them build their best practices model. The software provides detailed reporting and analytics to allow carriers to see their claim trends in real-time.

Choosing the Right Recommendation Model

The liability and injury evaluation step of the third party claims process is essential to get the liability and injury evaluation step right each time to can lay the foundation for timely and accurate claim settlements. A best practices model helps carriers align their claims handling philosophy with the day-to-day activities happening across the company and provides adjusters with the tools they need to succeed. While the historical claims data model may be somewhat quicker to set up, we believe using a best practices recommendation model is the right choice for long-term success.