A Guide to Making Specialty Bill Review a Good Fit for You: An Account Manager's Perspective

In the complex world of medical bill review, specialty bill review stands out as a powerful tool for achieving significant savings. Chad Countryman, a seasoned account success director at Enlyte, shares his insights on how he coaches clients to understand and implement FairPay Flex effectively.

Q: How do you explain the powerful value that FairPay Flex delivers?

Countryman: In its essence, FairPay Flex provides additional savings where a discrete fee schedule may not exist or outperform traditional network solutions in those places where a fee schedule may not cover charges. FairPay Flex is really an opportunity for clients to take advantage of additional savings opportunities that may not exist in a traditional network model.

Q: How does FairPay Flex provide an advantage in state-specific instances?

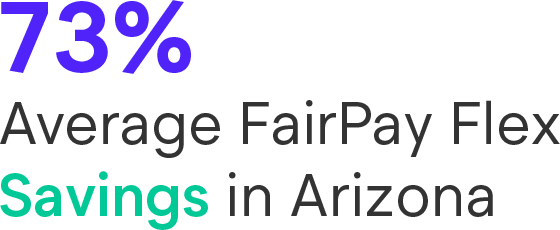

Countryman: Arizona has a discrete fee schedule for physician bills, and the fee schedule is pretty tight there, whereas for inpatient, outpatient and ambulatory surgery centers, there's not one. When you take FairPay Flex and put that in a primary spot in Arizona, it outperforms any network solution from a savings standpoint by 20-30 points.

The litigation or regulatory environment in Arizona is very friendly towards specialty bill review. There's case law, there's precedent that's been set. So, the pushback, savings, etc., is really good.

Q: Is specialty bill review worth more provider noise?

Countryman: One of the common misconceptions with specialty bill review is the provider noise. It certainly has a little bit more noise than a traditional network because of the nature of it. It's not a contracted product and it features, in many cases, where there's not a discrete fee schedule. However, when you peel it back, the savings are incredibly solid, even with possible disputes, inquiries, etc.

Q: What can be done to reduce provider noise?

Countryman: Using data-driven decisions to manage the program can help minimize provider noise. Many times the noise is in the form of reconsiderations or legal disputes that do not outweigh the savings achieved by the solution.

Adjusters need to send all those phone calls and inquiries to the FairPay Flex team. There's no way that an adjuster or a client contact can really explain how those reductions took place.

If there is a critical provider in a client's geography, employer mix, etc., they can turn off that specific provider so that FairPay Flex isn't being utilized at the TIN level.

Q: Enlyte's approach to handling disputes is a key differentiator to competing solutions?

Countryman: Enlyte's approach to handling disputes is a key selling point. Enlyte has a team dedicated to handling all those disputes from start to finish. This is a key benefit for FairPay Flex clients. You can rely on our team of attorneys and outside counsel in all the states to handle dispute resolution—and this is included in the price of the FairPay Flex solution.

Q: What happens if I don’t use FairPay Flex?

Countryman: You're not going to save the same amount of money on your medical as you could and the same amount that the carrier down the street is. FairPay Flex does have impact on the customer’s bottom line affecting premiums and ratios alike.

Q: How does FairPay Flex fit into my cost containment strategy?

FairPay Flex is one tool in the toolbox. It's not something that's going to save money on every type of bill in every state. It's one more tool to ensure that you are maximizing the savings potential and not overpaying for these medical services.

By following Countryman's approach, clients can better understand the value of FairPay Flex and implement it effectively as part of their overall cost containment strategy.